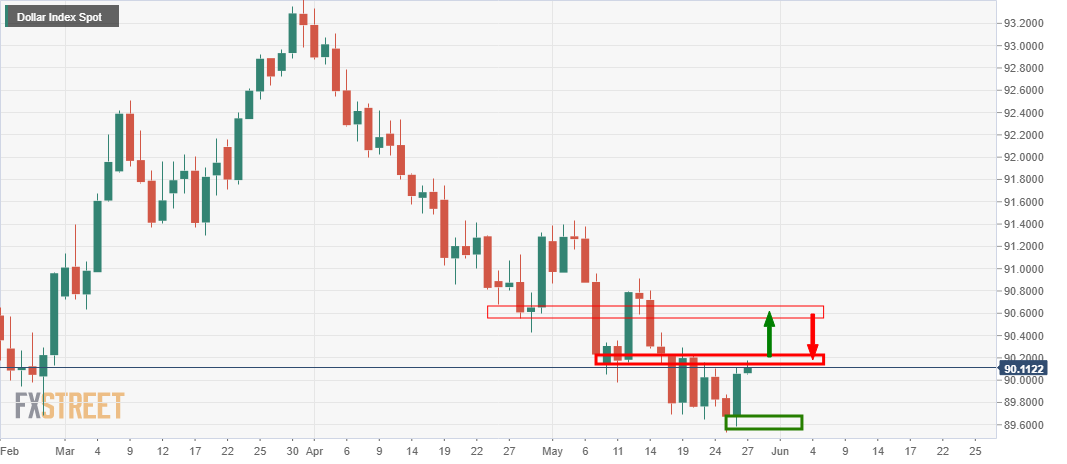

- US dollar takes a leap of faith into daily resistance.

- US yields supporting the bid tone in the greenback ahead of key data.

The greenback is finding support on Thursday as traders back the buck ahead of key data for the end of the week.

Investors are starting to come around to the idea that the Federal Reserve is surely edging towards a discussion about tightening monetary policy.

Data in mid-May showed April US CPI running at an annual clip of 4.2% which stalled a downtrend in the greenback.

Yesterday’s central bank action came in the form of a hawkish Reserve Bank of New Zealand which has laid the foundations of such sentiment in a post covid world.

Traders now await crucial US inflation data this week in the form of PCE as the US 10-year nominal yield firms in Asia to a high of 1.5830%.

Economists expect core PCE prices to jump 2.9% year-on-year in April, compared with a year-on-year rise of 1.8% a month earlier. The data is published on Friday.

If PCE is stronger than expected, yields could rise and power the dollar higher.

The market may also get a reality check in May’s Chicago PMI.

”We see upside risks to both readings that will make it hard to justify a 10-year yield near 1.50%,” the BBH analysts forecasted.

DXY technical analysis

The bulls could take charge here for a look-in at the next resistance where an initial test would be expected to fail according to what would be an over extended W-formaiton.

Meanwhile, failing that, the price will be trapped between current support and resistance.