- The greenback drops and rebounds from the 93.90 region.

- Italian politics lent temporary support to EUR, boosting EUR/USD.

- US markets remain closed on Monday due to the Memorial Day holiday.

The greenback, in terms of the US Dollar Index (DXY), is now staging a rebound from earlier lows in the 93.90/85 band, regaining the 94.00 handle and beyond.

US Dollar re-targets YTD tops around 94.30

The index is now recovering part of the ground lost during early trade, after auspicious news from the Italian political scenario boosted the demand for the single currency and therefore motivated the single currency to rebound from Friday’s multi-month lows vs. the buck.

Despite the current knee-jerk, the prospect for the greenback remains constructive in the near to medium terms, always on the back of the divergence in monetary policy between the Federal Reserve and the rest of its peers as well as the healthy economic fundamentals in the US.

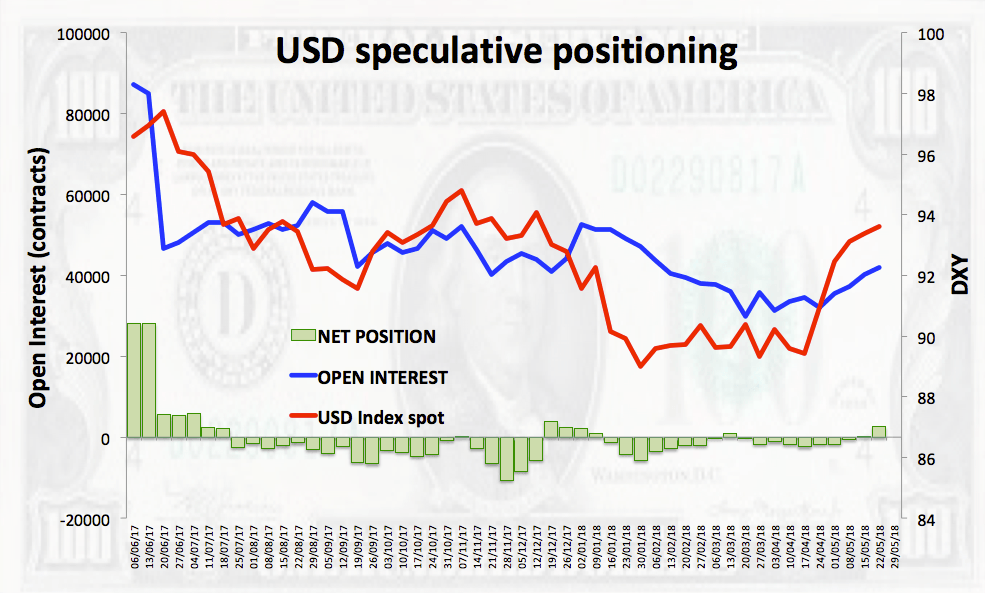

On the positioning front, USD speculative net longs rose to 2-week peaks on the week to May 22 as per the latest CFTC report.

Looking ahead, it will be a busy US calendar, with ADP report and another revision of the Q1 GDP on Wednesday, inflation tracked by the PCE on Thursday and May’s Non-farm Payrolls on Friday.

US Dollar relevant levels

As of writing the index is losing 0.19% at 94.09 and the breach of 93.71 (10-day sma) would target 93.30 (low May 21) en route to 93.12 (21-day sma). On the upside, the immediate hurdle lines up at 94.30 (2018 high May 25) followed by 95.15 (monthly highs Oct/Nov. 2017) and finally 96.51 (high Jul.4 2017).