- DXY meets support in the 93.20/15 band post-FOMC.

- The Fed kept the FFTR unchanged at its meeting on Wednesday.

- Weekly Claims and advanced Q2 GDP figures next of relevance.

The greenback, when tracked by the US Dollar Index (DXY), is recovering some ground lost after bottoming out in the 93.20/15 band and it manages to post decent gains in the 93.60 region on Thursday.

US Dollar Index bid ahead of key data

Following the drop to levels last seen in May 2018 in the 93.20/15 band, the index appears to have regained some composure and it is now navigating the mid-93.00s as market participants continue to digest the latest FOMC event and shift their focus to the upcoming key data releases.

In fact, the Federal Reserve left the Fed Funds Target Range (FFTR) unchanged as broadly expected on Wednesday. The Committee noted the improvement in the economic activity as of late, although it acknowledged that those levels still remain well below pre-coronavirus levels. The Fed also reiterated its commitment to use “its full range of tools” when comes to support the economy. In addition, the Fed made no changes to the QE programme and extended to December 31 its lending facilities aimed at counteracting the impact of the pandemic on the economy.

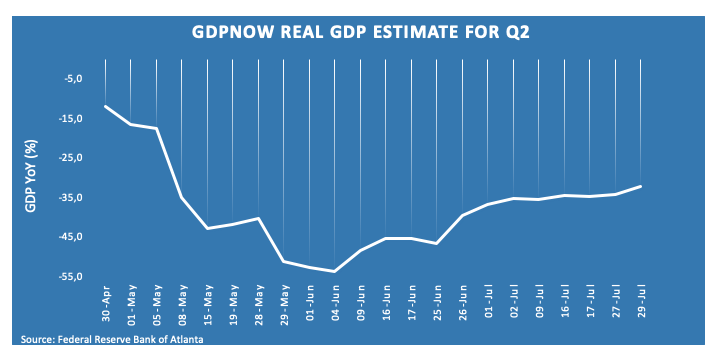

In the US data space, the weekly Initial Claims will be once again in the centre of the debate along with the preliminary reading of the GDP for the April-June period.

What to look for around USD

The dollar remains under heavy pressure despite the ongoing rebound, as investors keep the bearish stance on the currency unchanged against the usual backdrop of US-China geopolitical jitters, the spread of the pandemic and efforts to return to a somewhat normal economic activity. Also weighing on the buck, market participants seem to have shifted their preference for other safe havens instead of the greenback on occasional bouts of risk aversion. On another front, the speculative community kept adding to the offered note around the dollar for yet another week, opening the door to a potential development of a more serious bearish trend in the dollar.

US Dollar Index relevant levels

At the moment, the index is gaining 0.26% at 93.50 and a break above 94.20 (38.2% Fibo of the 2017-2018 drop) would open the door to 96.03 (50% Fibo of the 2017-2018 drop) and finally 96.98 (55-day SMA). On the other hand, the next down barrier lines up at 93.18 (2020 low Jul.29) seconded by 91.80 (monthly low May 18) and finally 89.23 (monthly low April 2018).