- DXY loses further ground and returns to the 92.50 region.

- Biden keeps the lead vs. Trump as vote counting is underway.

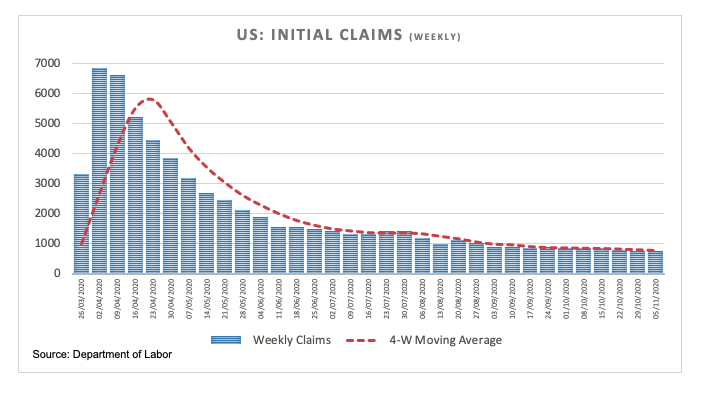

- US Initial Claims came in at 751K during last week.

The US Dollar Index (DXY), which tracks the greenback vs. a basket of its main competitors, remains well on the defensive in the vicinity of 92.50, or 2-month lows.

US Dollar Index offered on risk appetite, looks to FOMC

The index accelerates the downside and tests levels last seen in mid/late-October around 92.50 against the backdrop of the solid sentiment surrounding the risk-associated complex.

The upbeat note in the riskier assets comes in response to rising bets of a Biden presidency, as the Democrat candidate remains in the lead with six states still counting votes.

In the US data space, weekly Claims rose by 751K, coming in short of initial expectations. Previously, Challenger Job Cuts shrunk to 80.87K in October (from 118.80K).

Later in the session, the FOMC is predicted to keep the Fed Funds Target Range unchanged at 0.00%-0.25%.

What to look for around USD

The index failed to extend the move beyond the 94.30 area on Wednesday and instead appears to have resumed the downside towards the 93.00 level. Rising probability of a Biden presidency keeps weighing on the dollar, although prospects of a “blue wave” looks largely diminished. On the more macro view, the impact of the second wave of the pandemic on the economy could favour the re-emergence of the risk aversion and thus some support for the buck. Later in the session, the greenback should remain under the microscope in light of key data releases and the FOMC meeting.

US Dollar Index relevant levels

At the moment, the index is losing 0.80% at 92.72 and faces immediate contention at 92.47 (monthly low Oct.21) seconded by 91.92 (23.6% Fibo of the 2017-2018 drop) and then 91.880 (monthly low May 2018). On the other hand, a breakout of 94.30 (monthly high Nov.3) would open the door to 94.74 (monthly high Sep.25) and finally 96.03 (50% Fibo of the 2017-2018 drop).