- DXY reverses Monday’s pullback and retakes the 92.30 area.

- US 10-year yields climb to the 1.70% region on Tuesday.

- US inflation figures tracked by the CPI takes centre stage.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, manages to regain composure and tests once again the 92.30 area.

US Dollar Index looks to data

The index trades within a choppy performance in the first half of the week, although manages well to keep business above the key support at 92.00 the figure.

The consolidative mood in the buck comes along the rebound in US yields, with the 10-year note creeping higher and approaching the key 1.70% level following Monday’s auction.

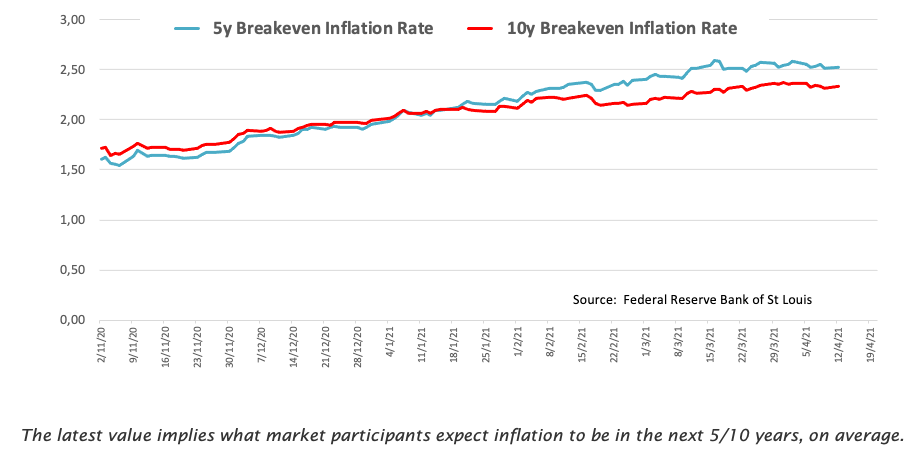

On the broader picture, investors appear to have already priced in the outperformance of the US economy vs. the rest of its G10 peers and seem to have shifted the focus to Europe and the prospects of higher US consumer prices in response to extra fiscal stimulus.

In the US data space, all the attention will be on the release of the March inflation figures measured by the CPI, all against the backdrop of rising speculation regarding higher inflation in the next months.

Additional data include the NFIB Business Optimism Index for the month of March and the weekly report on US crude oil supplies by the API.

Furthermore, San Francisco Fed M.Daly (voter, centrist), Kansas City Fed E.George (2022 voter, hawkish) and Atlanta Fed R.Bostic (voter, centrist) are all due to speak later on Tuesday.

What to look for around USD

The dollar keeps navigating the lower bound of the recent range just above the 92.00 neighbourhood after being rejected from YTD highs near 93.50 back in March. DXY now looks under downside pressure, as investors seem to have already priced in the US reflation/vaccine trade. Furthermore, the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery (now postponed to later in the year) remain a source of support for the risk complex and carry the potential to curtail the upside momentum in the dollar in the second half of the year.

Key events in the US this week: March Inflation figures (Tuesday) – Chairman Powell speech, Fed’s Beige Book (Wednesday) – Retail Sales, Initial Claims, Philly Fed Index, Industrial Production (Thursday) – Housing Starts, Building Permits, advanced Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.22% at 92.28 and a break above 93.43 (2021 high Mar.31) would expose 94.00 (round level) and finally 94.30 (monthly high Nov.4). On the other hand, the next contention emerges at 91.99 (weekly low Apr.8) followed by 91.56 (50-day SMA) and then 91.30 (weekly low Mar.18).