- The index quickly moves higher to the 95.70 area.

- Yields of the US 10-year note drop to lows around 2.69%.

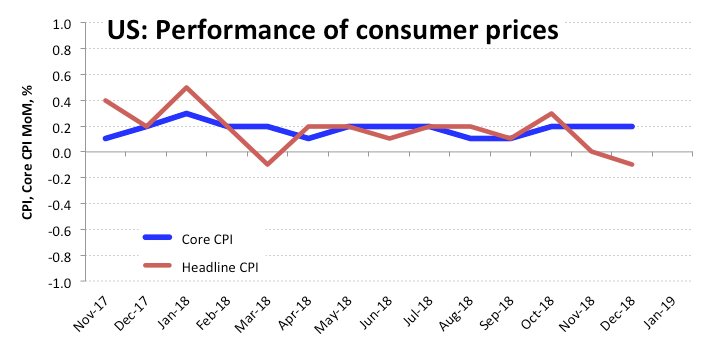

- US December Core CPI rose 0.2% MoM, in line with forecasts.

Tracked by the US Dollar Index (DXY), the greenback has reverted the daily losses and is now navigating the upper end of the range near 95.70, or fresh session peaks.

US Dollar Index now targets 96.00

With no apparent catalyst behind the sharp up move, the index has once again the critical 96.00 handle on his crosshairs, coincident with the key 100-day SMA.

Earlier in the session, US inflation figures for the month of December matched prior surveys, as Core CPI rose 0.2% MoM and 2.2% on a yearly basis. Further data saw headline consumer prices dropping 0.1% inter-month and advancing at an annualized 1.9%, always in line with previous estimates.

What to look for around USD

The Fed’s probable re-pricing of the tightening pace in the next months continues to gather traction among investors as well as the performance of the US fundamentals. That said, there are speculations that the economy could enter a technical recession at some point in 2020. Sustaining the grim near term outlook on the buck, the Fed’s stance now signals more patience and flexibility, while extra progress in the US-China trade talks should also exert further downside pressure in the currency.

US Dollar Index relevant levels

At the moment, the pair is gaining 0.15% at 95.70 and a breakout of 95.89 (10-day SMA) would open the door to 96.38 (21-day SMA) and then 96.96 (2019 high Jan.2). On the downside, the next support is located at 95.03 (2019 low Jan.10) seconded by 94.88 (200-day SMA) and finally 94.79 (low Oct.16 2018).