- DXY extends the upside beyond 91.70, new YTD highs.

- Yields keep the march north unabated and target 1.60%.

- US Nonfarm Payroll will take centre stage later in the session.

The greenback, when tracked by the US Dollar Index (DXY), extends the upbeat momentum and approaches the 92.00 barrier on Friday.

US Dollar Index up on yields, looks to data

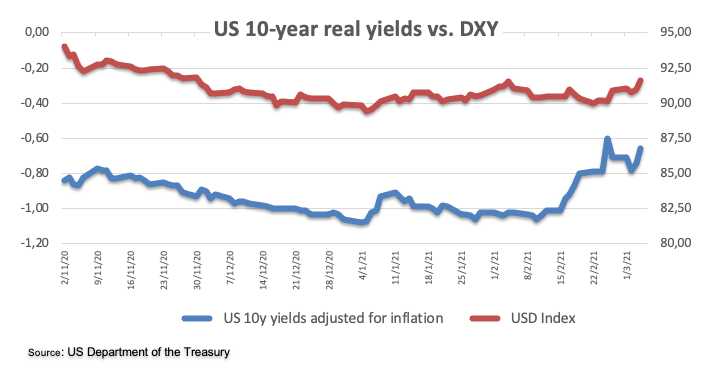

The index advances for the third session in a row and gradually approaches the key barrier at 92.00 the figure, always on the back of the unabated move higher of US real yields.

Supporting the above, Chairman Powell showed no concerns regarding the persistent moderate climb in yields. In addition, the outperformance of the US economy coupled with the strong pace of the vaccine rollout continues to lend support to the buck and move away as a key driver of the price action in the risk complex.

Later in the session, all the attention will be on the US labour market report, where the economy is expected to have created 182K jobs and the unemployment rate is seen unchanged at 6.3% in February.

What to look for around USD

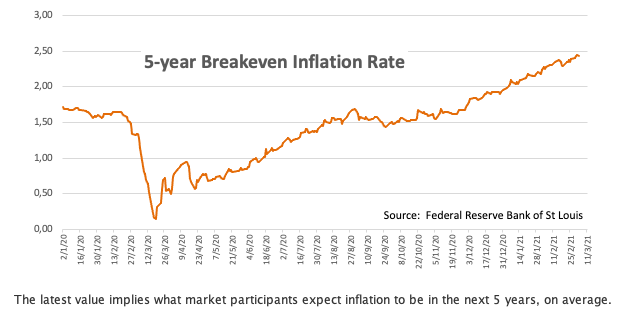

The sentiment in the dollar remains firm and push the index closer to the 92.00 neighbourhood. The reversion of the recent weakness in the dollar came in tandem with the strong bounce in yields to levels last recorded a year ago, all against the backdrop of rising investors’ concerns over the probability of higher inflation in the next months. In fact, market participants appear to be looking past the mega-accommodative stance from the Fed (until “substantial further progress” is seen) and the imminent extra fiscal stimulus, bolstering the renewed interest for the dollar.

Key events in the US this week: Nonfarm Payrolls (Friday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.08% at 91.71 and a breakout of 91.77 (2021 high Mar.5) would open the door to 92.46 (23.6% Fibo of the 2020-2021 drop) and finally 92.93 (200-day SMA). On the other hand, the next support emerges at 90.47 (50-day SMA) seconded by 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6).