- The index reverts Thursday’s gains and returns to 95.35/30.

- Yields of the US 10-year note tumble to lows around 2.71%.

- US December CPPI figures next of relevance later in the calendar.

The greenback, tracked by the US Dollar Index (DXY), is resuming the weekly downside and navigates the area of daily lows around 95.30.

US Dollar Index looks to US CPI

The index has entered the fourth consecutive week into the red territory, coming down following the rejection from November and December peaks in the 97.70 zone.

The change of heart among investors has been hurting the buck in past weeks, at the time when speculations over the likeliness of a re-assessment of the Fed’s policy keep gaining ground. Somewhat supporting this view, recent Fed speakers and the dovish tone from the latest FOMC minutes point to a more ‘patient and flexible’ Fed.

The greenback is expected to remain under pressure today in light of the publication of US December’s inflation figures gauged by the CPI.

What to look for around USD

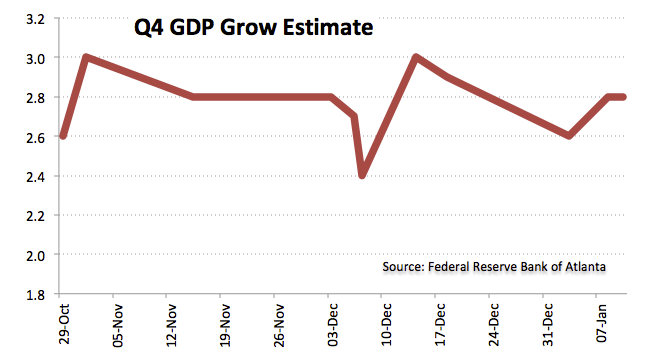

The Fed’s probable re-pricing of the tightening pace in the next months continues to gather traction among investors as well as the performance of the US fundamentals. That said, there are speculations that the economy could enter a technical recession at some point in 2020. Sustaining the grim near term outlook on the buck, the Fed’s stance now signals more patience and flexibility, while extra progress in the US-China trade talks should also exert further downside pressure in the currency.

US Dollar Index relevant levels

At the moment, the pair is losing 0.15% at 95.41 facing the next support at 95.03 (2019 low Jan.10) seconded by 94.88 (200-day SMA) and finally 94.79 (low Oct.16 2018). On the other hand, a breakout of 95.89 (10-day SMA) would open the door to 96.38 (21-day SMA) and then 96.96 (2019 high Jan.2).