- DXY breaches the 94.00 level and records fresh YTD lows.

- The dollar tested the 93.80 region, levels last seen in September 2018.

- Durable Goods Orders, Dallas Fed index next of relevance.

The greenback, when gauged by the US Dollar Index (DXY), is accelerating the decline and broke below the 94.00 support to clinch fresh lows in the vicinity of 93.80, area last visited in September 2018.

US Dollar Index focused on risk trends

Investors continue to unwind USD-long positions at the beginning of the week and ahead of the opening bell in the Old Continent, dragging the index to new 22-month lows near 93.80.

Massive doses of stimulus by global central banks in order to counteract the impact of the pandemic, encouraging news suggesting a vaccine could be delivered in the medium-term and positive results from key fundamentals supporting the idea of a strong recovery are all eclipsing data indicating that the pandemic not only remains unabated but it is also picking up pace once again in Europe and Asia.

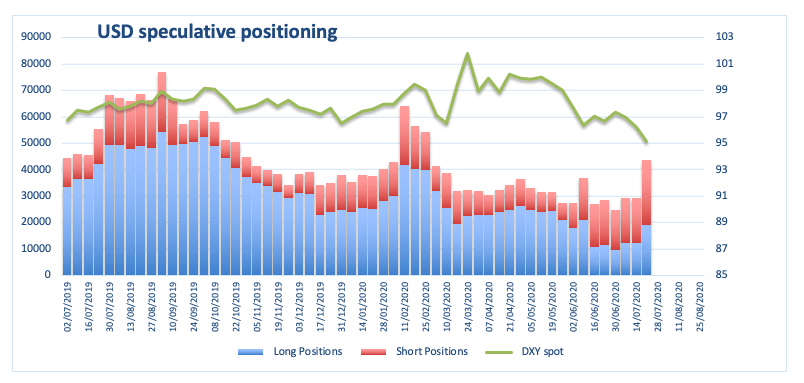

The dollar is also retreating within the speculative community, where net shorts climbed to the highest level since late November 2017 during the week ended on July 21 and according to the latest CFTC Positioning Report. This adds to the idea that a noticeable bearish move is developing around the buck.

In the US data space, Durable Goods Orders for the month of June are due later in the NA session seconded by the Dallas Fed Index.

What to look for around USD

The relentless advance of the coronavirus pandemic in the US and across the world vs. the probability that a COVID-19 vaccine could be out in the medium-term plus the ongoing reopening of global economies are all driving the sentiment in the global markets while keeping the demand for the safe haven dollar well depressed. While bouts of risk aversion are seen supportive of the greenback, these seem quite unlikely, at least in the near-term , in the current context and therefore any rebound in DXY should be deemed as short-lived. On another front, the speculative community kept adding to the offered note around the dollar for yet another week, opening the door to a potential development of a more serious bearish trend in the dollar.

US Dollar Index relevant levels

At the moment, the index is losing 0.41% at 93.96 and faces the next support at 93.84 (2020 low Jul.27) seconded by 93.81 (monthly low Sep.21 2018) and then 93.71 (monthly low Jul.9 2018). On the other hand, a break above 96.03 (50% Fibo of the 2017-2018 drop) would aim for 97.35 (55-day SMA) and finally 97.80 (weekly high Jun.30).