- DXY eases to the vicinity of 98.20 post-Payrolls.

- Yields of the US 10-year note drop to 1.55%.

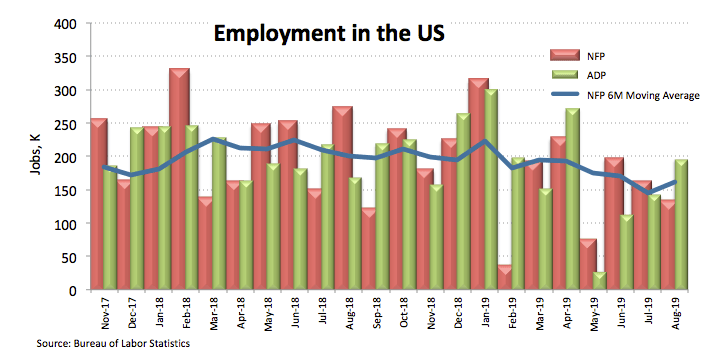

- US Payrolls missed estimates at 130K in August.

The US Dollar Index (DXY), which tracks the buck vs. its main competitors, has now come under some selling pressure and visits the 98.20 region, daily lows.

US Dollar Index now looks to Powell

The index is now easing further ground and threatens to challenge weekly lows near the key support at 98.00 the figure (Thursday). In fact, the daily upside in the buck failed around the 200-hour SMA in the mid-98.00s, sparking the ongoing correction soon after.

DXY remains on the defensive after US Non-farm Payrolls came in on a mixed tone for the month of August. While the job creation disappointed investors at 130K, the unemployment rate stayed unchanged at 3.7% and the key Average Hourly Earnings (a gauge of wage inflation) surpassed estimates expanding 0.4% inter-month and 3.2% from a year earlier.

Later in the day, Chief Jerome Powell will speak at the University of Zurich on the US economic outlook and monetary policy, keeping the Greenback under the microscope.

What to look for around USD

The index is closing the week on a poor performance despite recording new yearly peaks well above the 99.00 handle earlier in the week. If the selling pressure gathers extra pace in response to Powell’s speech, DXY carries the potential to put the 98.00 support to the test later today. After bottoming out near the 98.00 mark on Thursday, the constructive view in DXY still looks firm in spite of renewed speculations on a probable recession in the US economy at some point in the next couple of years. Supporting the case for a strong USD emerge the solid labour market, strong consumer confidence and positive GDP readings as of late, while inflation is seeing regaining upside traction in the near term.

US Dollar Index relevant levels

At the moment, the pair is retreating 0.15% at 98.22 and a breach of 98.09 (monthly low Sep.5) would aim for 97.58 (55-day SMA) and finally to 97.17 (low Aug.23). On the upside, the next hurdle aligns at 99.37 (2019 high Sep.3) seconded by 99.89 (monthly high May 11 2017) and then 100.00 (psychological level).