- DXY breaches 96.00 and records fresh 2020 lows around 95.70.

- US 10-year yields debilitate further to 0.70% on safe haven demand.

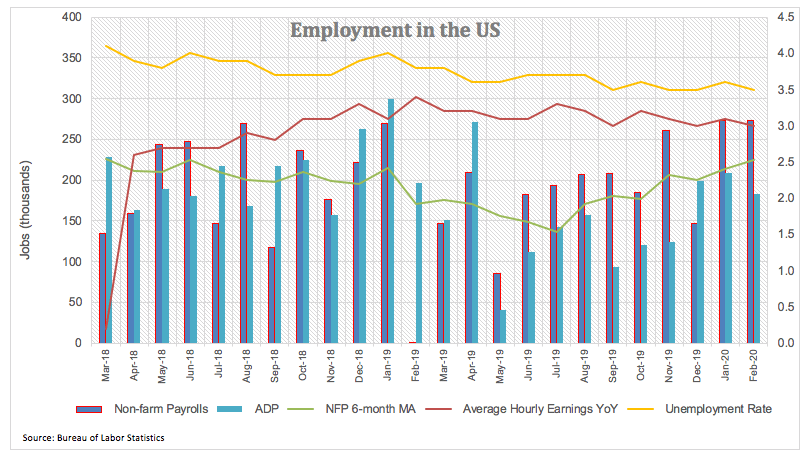

- US Non-farm Payrolls bettered estimates in February at 273K.

The US Dollar Index (DXY), which tracks the buck vs. a bundle of its main competitors, remains entrenched into the negative territory and is now hovering around the 95.80 region.

US Dollar Index in yearly lows near 95.80

The index is down for the second consecutive session on Friday, although it has extended the sell off sharply to levels last seen in March 2019 in the 95.80 region, always on the back of noticeable drop in US yields and increasing speculation of further interest rate cuts by the Federal Reserve (as soon as the March 17-18 meeting).

In fact, unremitting concerns on the impact of the fast-spreading coronavirus on the US economy prompted the Fed to cut rates by 50 bps on Tuesday, recording the first rate cut in-between meetings since the global financial crisis in 2008.

By the same token, yields of the key US 10-year note have tumbled to historic lows in the 0.70% region, all playing against the buck and forcing DXY to shed more than 4% since 2020 tops in the 99.90 region to Friday’s lows in the 95.75/70 band.

In the docket, the dollar remained apathetic despite another solid print from the US labour market report. This time, the economy created 273k jobs during January, leaving behind forecasts and matching the January reading. In addition, the jobless rate ticked lower once again to multi-decade lows at 3.5% and wage inflation pressures remained reticent in the 3.0% region on a yearly basis.

US Dollar Index relevant levels

At the moment, the index is losing 0.81% at 95.82 and faces the next support at 95.74 (2020 low Mar.6) seconded by 95.16 (low Jan.31 2019) and then 95.03 (2019 low Jan.10 2019). On the upside, a break above 96.36 (monthly low Dec.31 2019) would aim for 97.11 (monthly low Nov.1 2019) and finally 97.80 (200-day SMA).