- DXY pushes higher and approaches the 91.00 level.

- Yields of the US 10-year note trade closer to 1.70%.

- Initial Claims, Producer Prices, Fedspeak come up next.

The greenback, in terms of the US Dollar Index (DXY), adds to Wednesday’s sharp gains and trades at shouting distance from the key 91.00 barrier on Thursday.

US Dollar Index bid on higher yields, inflation

The index advances for the second session in a row and gradually approaches the 91.00 barrier on the back of the improved sentiment surrounding the buck.

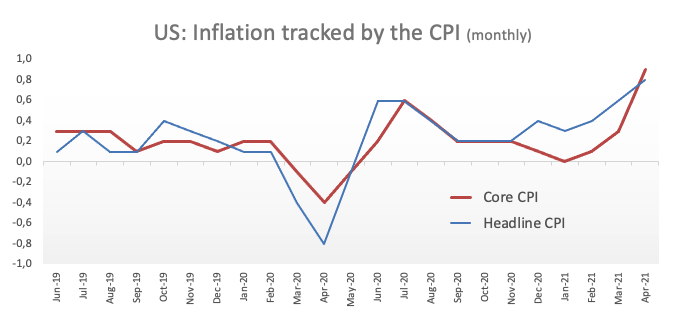

Indeed, the dollar regained attention after US inflation figures for the month of April surprised to the upside on Wednesday. In fact, headline consumer prices rose 0.8% MoM and 4.2% from a year earlier, while Core prices gained 0.9% inter-month and 3.0% over the last twelve months.

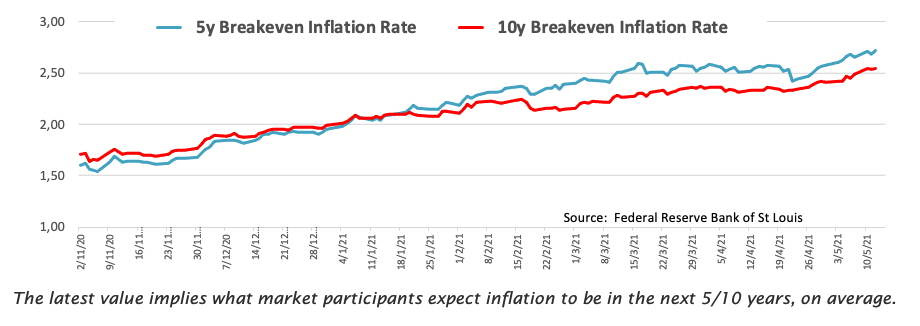

It is worth recalling, however, that FOMC’s R.Clarida once again talked down current bouts of higher inflation deeming them as transitory, while he expects inflation to run above the Fed’s 2% target next year and in 2023 and also expressed his concerns over the uncertainty surrounding the labour market.

The higher-than-expected results pushed yields higher and propped up fresh demand for the buck, prompting the index to extend the rebound from monthly lows in the 90.00 neighbourhood.

Next in the US data space will be the usual weekly Claims seconded by Producer Prices for the month of April. In addition, FOMC’s C.Waller (permanent voter, centrist) and St. Louis Fed J.Bullard (2022 voter, dovish) are due to speak later in the NA session.

What to look for around USD

The index extends the recovery in the second half of the week and targets the key 91.00 barrier in the short-term. Recent bouts of risk aversion plus higher inflation figures lent some much-needed oxygen to the dollar, although the negative stance on the currency appears to dominate the broader scenario in the longer run. This view has been exacerbated following April’s NFP, hurting at the same time the sentiment surrounding the imminent full re-opening of the US economy, which is in turn sustained by the unabated strength in domestic fundamentals, the solid vaccine rollout and once again the resurgence of the market chatter regarding an anticipated tapering. The latter comes in despite Fed’s efforts to talk down this scenario, at least for the next months.

Key events in the US this week: Initial Claims (Thursday) – Retail Sales, Industrial Production, flash May Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families worth nearly $4 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is gaining 0.03% at 90.79 and a breakout of 91.07 (100-day SMA) would open the door to 91.43 (weekly/monthly high May 5) and finally 91.69 (50-day SMA). On the flip side, immediate contention lines up at 89.98 (monthly low May 11) followed by 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6).