- DXY remains depressed near fresh lows around 90.30.

- US Core CPI came in flat on a monthly basis in January.

- Chief Powell will speak later on the US labour market.

The US Dollar Index (DXY), which measures the greenback vs. a basket of its G10 peers, keeps the selling bias unchanged at trades close to the weekly lows 90.30.

US Dollar now looks to Powell

The index retreats for yet another session on Wednesday and flirts at the same time with the 2020-2021 line. A breach of this area on a sustainable fashion could put the buck under further downside pressure.

Other than the better mood in the risk complex, the dollar loses ground in tandem with declining yields of the US 10-year benchmark, which have suddenly dropped below 1.15% in the wake of the inflation data.

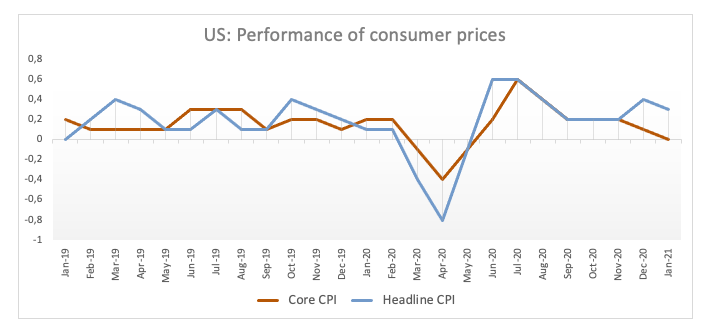

In fact, US inflation figures tracked by the headline CPI noted consumer prices rose at a monthly 0.3% in the first month of the year, while prices excluding food and energy costs came in flat.

Later in the session, the EIA will release its weekly report on US crude oil stockpiles ahead of the speech by Fed’s Powell.

What to look for around USD

The dollar’s corrective upside run out of steam in the 91.60 on Friday, triggering a strong leg lower afterwards. Bouts of occasional strength in US yields remain the almost exclusive driver of bullish attempts in the buck helped with firm growth prospects and auspicious (and fast) vaccine rollout vs. its G10 peers. The continuation of the downtrend in the dollar looks the most likely scenario against the backdrop of the fragile outlook for the currency in the medium/longer-term, and always amidst the current massive monetary/fiscal stimulus in the US economy, the “lower for longer” stance from the Fed and prospects of a strong recovery in the global economy, which is expected to morph into extra appetite for riskier assets.

Key events this week in the US: Chief Powell’s speech on “The State of the US Labor Market” (Wednesday) and the preliminary gauge of the Consumer Sentiment for the month of February (Friday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Trump’s impeachment. Tapering speculation vs. economic recovery. US real interest rates vs. Europe.

US Dollar Index relevant levels

At the moment, the index is retreating 0.11% at 90.34 and faces initial support at 90.25 (weekly low Feb.10) followed by 90.04 (weekly low Jan.21) and then 89.20 (2021 low Jan.6). On the upside, a breakout of 91.60 (2021 high Feb.5) would open the door to 91.74 (100-day SMA) and finally 92.46 (23.6% Fibo of the 2020-2021 drop).