- DXY looks for direction around Monday’s close.

- Risk-on trade creeps in as virus fears ebb.

- US Factory Orders, API’s report only due later.

The US Dollar Index (DXY), which gauges the greenback vs. a basket of its main competitors, is trading on a flat note in the 97.80 region.

US Dollar Index propped up by data, looks to China

The index has recovered most of the ground lost following Friday’s sharp sell-off at the beginning of the week, supported by somewhat easing concerns on the Chinese coronavirus and positive results from the domestic docket.

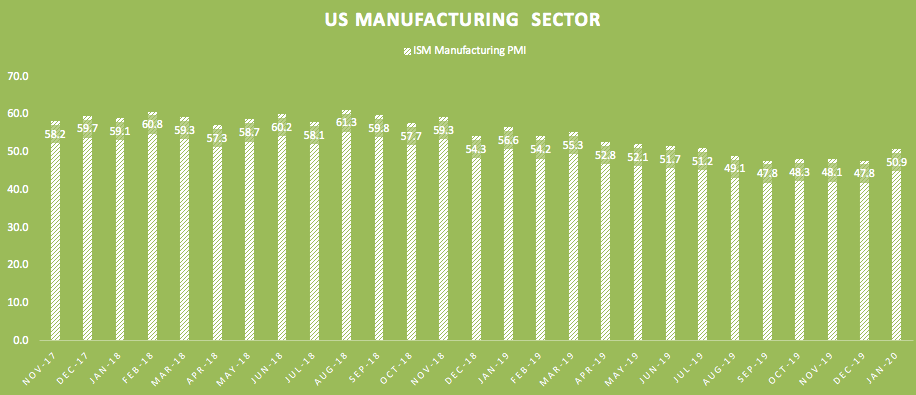

Indeed, the always-relevant ISM Manufacturing rebounded and returned to the expansion territory after improving to 50.9 in December (from 47.8). Further out, US yields inched higher helped by the upbeat mood in the risk complex and in the wake of the better-than-expected ISM data, all propping up the buck’s rebound from lows near 97.30.

Tuesday’s US docket only includes December’s Factory Orders and the weekly report by the American Petroleum Institute on US crude oil supplies.

What to look for around USD

The index managed to rebound from Friday’s drop to the proximity of 97.30 and regained the key 200-day SMA in the 97.70 region. Following the neutral/dovish message from the FOMC, investors are now focused on key indicators to be released later this week as well as any news on the Wuhan coronavirus. The recent breakout of the 200-day SMA has reasserted the constructive view on the dollar, which is expected to remain underpinned by the current ‘wait-and-see’ stance from the Fed vs. the broad-based dovish view from its G10 peers, auspicious results from the US fundamentals, the dollar’s safe haven appeal and its status of ‘global reserve currency’.

US Dollar Index relevant levels

At the moment, the index is advancing 0.02% at 97.82 and a break above 97.89 (weekly high Feb.3) would open the door to 98.19 (2020 high Jan.29) and finally 98.54 (monthly high Nov.29). On the other hand, immediate contention emerges at 97.35 (weekly low Jan.31) seconded by 97.09 (weekly low Jan.16) and then 96.36 (monthly low Dec.31 2019).