- The index trades within a tight range in the 96.00 area.

- US 10-year yields recede from tops near 2.70%.

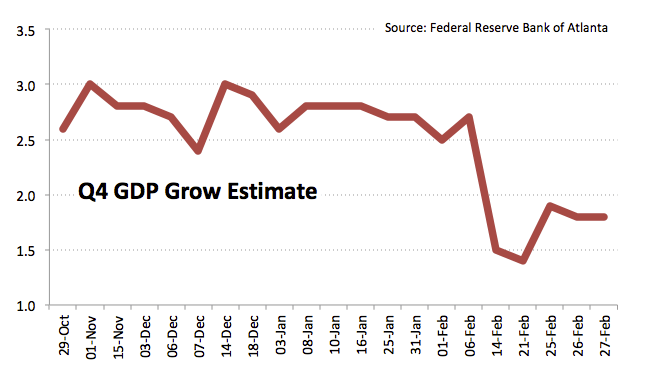

- First estimate of Q4 GDP next of relevance.

The greenback, in terms of the US Dollar Index, is looking to add to yesterday’s gains around the 96.00 region.

US Dollar Index looks to data

As expected, nothing new from Chief Powell at his second testimony before the House Financial Services Committee on Wednesday, although he hinted at the probability that the Fed could end the reduction of the balance sheet runoff any time soon.

The index, in the meantime, remains under pressure and keeps navigating the lower bound of the recent range in the vicinity of the 96.00 handle, always looking to the mood in the risk-associated space as the main driver for the price action as well as the progress in the US-China trade talks.

Looking ahead, the first revision of Q4 GDP figures will grab all the attention later in the day seconded by Initial Claims, the Chicago PMI and speeches by FOMC’s Kaplan, Harker and Bostic.

What to look for around USD

The US-China trade dispute remains in centre stage when comes to drive the global sentiment for the time being, while the Trump-Kim meeting left no relevant headlines so far. Today’s release of the first estimate of Q4 GDP will also give markets and idea of how the US economy fared in late 2018, amidst the almost generalized consensus that a recession could emerge at some point in 2020. Regarding monetary policy, Chief Powell reiterated at Capitol Hill that the Fed could end its QT later in the year.

US Dollar Index relevant levels

At the moment, the pair is losing 0.01% at 96.11 and a break below 95.88 (low Feb.26) would target 95.64 (200-day SMA) en route to 95.16 (low Jan.31). On the upside, the next hurdle emerges at 96.44 (21-day SMA) followed by 96.79 (23.6% Fibo of the September-December up move) and finally 97.37 (2019 high Feb.15).