- DXY trades without clear direction around the 91.00 level.

- Investors’ attention remains on yields and US inflation.

- Fed’s Powell, Initial Claims next of relevance in the docket.

The greenback, in terms of the US Dollar Index (DXY), struggles for direction around the 91.00 neighbourhood on Thursday.

US Dollar Index focused on Powell, data, yields

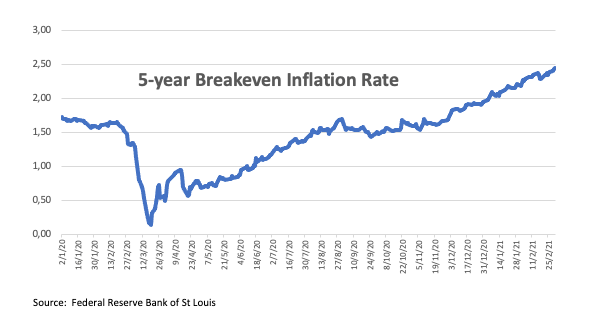

The index looks to add to Wednesday’s gains around the 91.00 region, always supported by investors’ rising perception of higher inflation in the next months, the solid pace of the US recovery as well as the vaccine rollout.

Indeed, the expected outperformance of the US economic recovery vs. its overseas peers continues to underpin the dollar’s momentum, reinforced as of late by auspicious results from domestic fundamentals. In addition, market participants keep adjusting to the likeliness of higher inflation on the back of the expected increment in fiscal stimulus.

Later in the NA session, Chairman Powell will participate in the event “Conversation on the US Economy” at The Wall Street Journal Jobs Summit. In the calendar, the usual weekly Claims are due seconded by Unit Labor Costs, Nonfarm Productivity and Factory Orders.

What to look for around USD

The index came under some correction following multi-week tops beyond the 91.00 mark earlier in the week. The reversion of the recent weakness in the dollar came in tandem with the strong bounce of yields to levels last recorded a year ago. Against this, occasional upside in the buck should remain short-lived amidst the broad-based bearish outlook for the currency in the medium/longer-term. This, in turn, is propped up by the reinforced mega-accommodative stance from the Fed until “substantial further progress” is seen, persistent chatter of extra fiscal stimulus and prospects of a strong recovery in the global economy, which are all seen underpinning the better sentiment in the risk complex.

Key events in the US this week: Initial Claims, Powell’s speech (Thursday) – Nonfarm Payrolls (Friday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.07% at 91.01 and a breakout of 91.39 (weekly high Mar.2) would open the door to 91.60 (2021 high Feb.5) and finally 92.46 (23.6% Fibo of the 2020-2021 drop). On the other hand, the next support emerges at 89.68 (weekly low Feb.25) seconded by 89.20 (2021 low Jan.6) and then 88.94 (monthly low March 2018).