- DXY keeps the bid tone unchanged around 93.70.

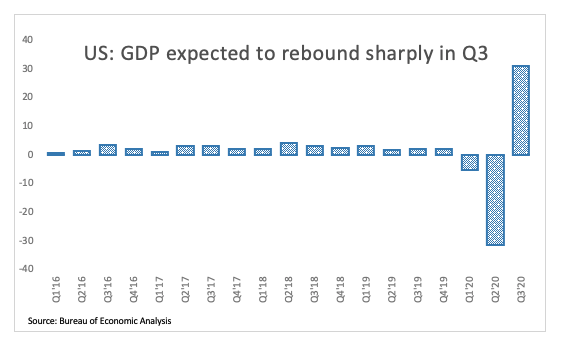

- US advanced Q3 GDP came in at 33.1%, above estimates.

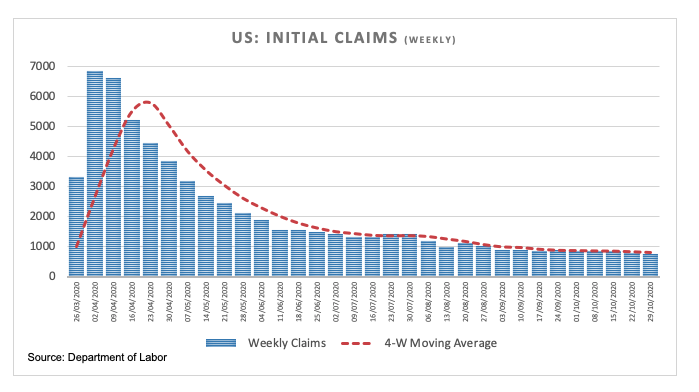

- Initial Claims rose at a weekly 751K also beating consensus.

The US Dollar Index (DXY), which gauges the greenback vs. a basket of its main rivals, sticks to the positive performance albeit off daily highs near 93.80.

US Dollar Index now looks to ECB

The index stays well bid so far on Thursday on the back of the prevailing risk aversion sentiment in the global markets and always amidst rising pandemic concers.

The dollar also manages to get extra support after flash Q3 GDP figures showed the economy is expected to expand just above 33% during the July-September period, surpassing initial estimates.

Also on the bright side, weekly Claims rose by 751K and extended the drop below the 800K mark for the second week in a row.

Investors’ attention now shifts to the upcoming ECB monetary policy meeting, with consensus so far favouring a dovish tilt in the central bank’s statement.

Still in the US, September’s Pending Home Sales will close the daily calendar.

What to look for around USD

The index managed to regain the area above the key 93.00 barrier so far this week. The current recovery in the dollar comes in response to the impact of the COVID-19 pandemic on the global growth prospects as well as dying chances of a deal between Democrats and Republicans over a new stimulus bill. However, the stance on the dollar is predicted to deteriorate in case Joe Biden wins the November elections, while the “lower for longer” stance from the Federal Reserve also caps occasional bullish attempts.

US Dollar Index relevant levels

At the moment, the index is gaining 0.31% at 93.73 and a break above 93.90 (weekly high Oct.15) would expose 94.20 (38.2% Fibo retracement of the 2017-2018 drop) and finally 94.74 (monthly high Sep.25). On the other hand the next support is located at 92.47 (monthly low Oct.21) followed by 91.92 (23.6% Fibo of the 2017-2018 drop) and then 91.80 (monthly low May 2018).