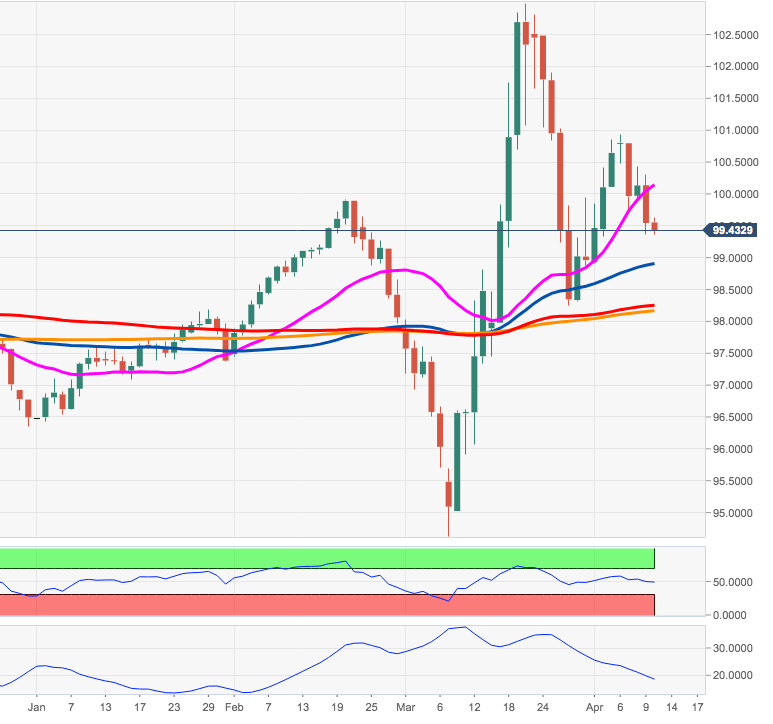

- DXY extends the downside after the rejection from 101.00.

- Interim support lines up at the 55-day SMA at 98.91.

DXY has come under increasing selling pressure following Monday’s tops in the boundaries of 101.00 the figure and after breaching the key support at the 100.00 mark afterwards.

If sellers regain the upper hand, then the 55-day SMA at 98.91 should provide initial contention ahead of the late-March lows near 98.30. This is considered the last defence for a test of the key 200-day SMA, today at 98.14.

On the broader picture, as long as the 200-day SMA holds the downside, the constructive outlook on the buck is expected to remain unchallenged.

DXY daily chart