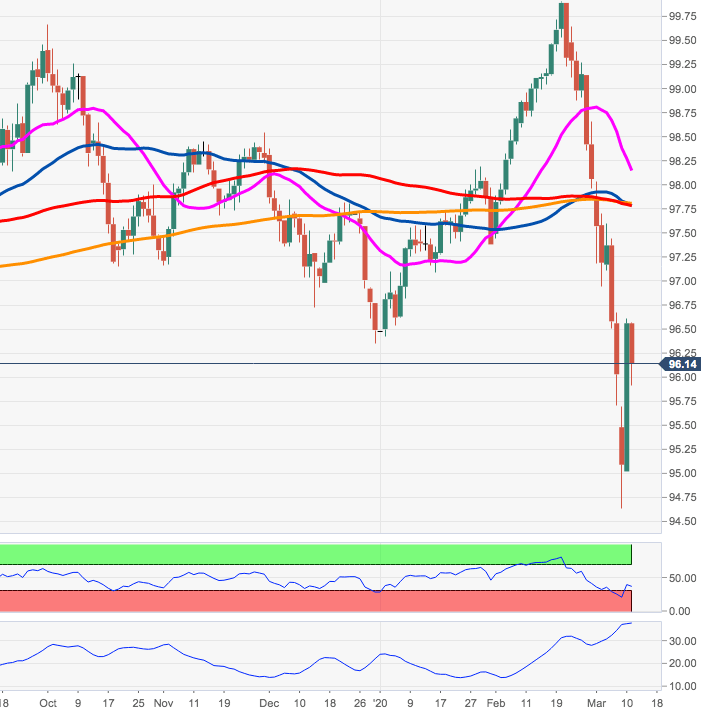

- Tuesday’s recovery lost upside vigour in the 96.50/60 band.

- The 200-day SMA in the vicinity of 97.80 caps the upside so far.

The sharp recovery in DXY met support in the 96.50/60 band on Tuesday, sparking the ongoing correction lower on Wednesday. This area of resistance is also reinforced by the resistance line off the 2019 low just above the 95.00 mark.

If sellers manage to regain control of the markets, then another test of YTD lows near 94.60 should re-emerge on the radar in the short-term horizon.

In the meantime, as long as the 200-day SMA in the 97.80 zone continues to cap the upside, the bearish stance on the buck should stay unaltered.

DXY daily chart