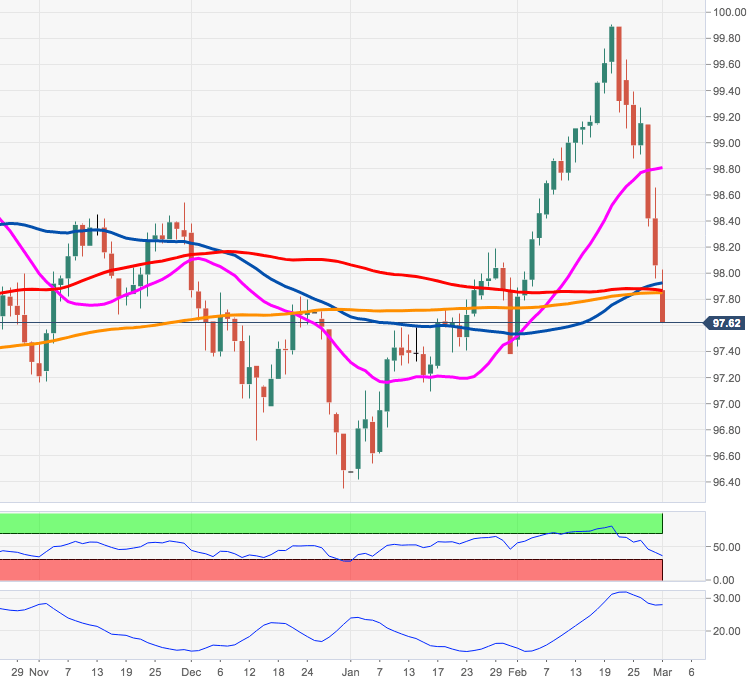

- DXY breaks below the key 200-day SMA in the 97.80/85 band.

- Further downside could see the February low at 97.37 retested.

DXY remains on the defensive at the beginning of the week and is extending the pullback further south of the 97.85/80 band, where sits the critical 200-day SMA.

While below this area, the outlook on the dollar should shift to negative (from constructive) and allow for the continuation of the decline, at least in the short-term horizon.

That said, the next support of relevance now emerges at the February low at 97.37 ahead of a Fibo retracement (of the 2020 rally) at 97.17.

DXY daily chart