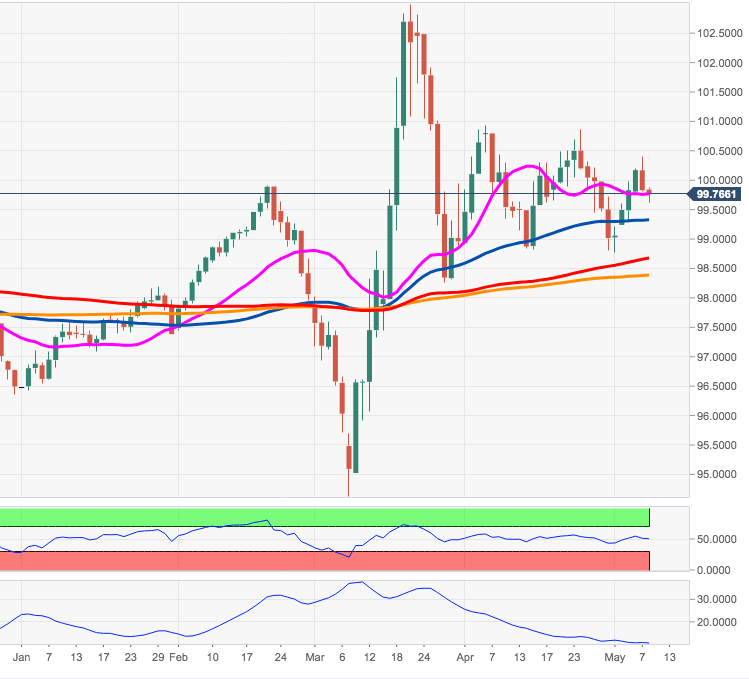

- DXY failed in the vicinity of the interim hurdle at 100.49.

- Immediately to the downside emerges the monthly low at 98.57.

DXY is extending the corrective downside to the area below the 100.00 mark following an unsuccessful attempt of breaking above the interim hurdle at the Fibo retracement at 100.49 on Thursday.

In the very near-term, and while sellers keep ruling the sentiment, the index could recede further and visit the area of 2-month lows in the 98.60/55 band (May 4).

Further out, the 200-day SMA in the 98.35/40 band is expected to hold the downside in the short-term horizon.

DXY daily chart