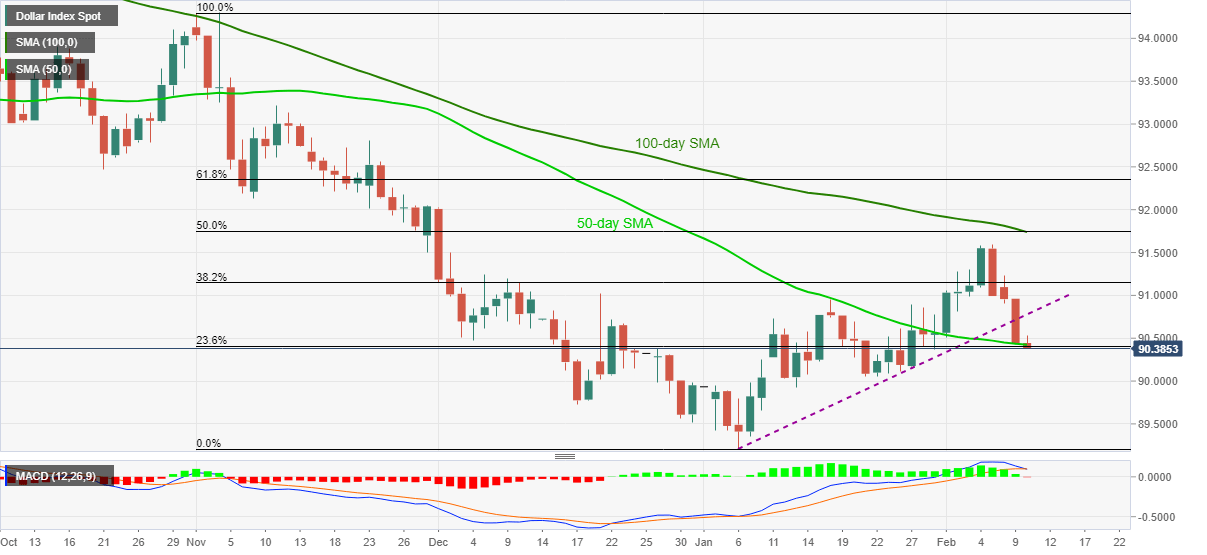

- DXY bears attack late January lows during the four-day declines.

- MACD flirts with bears, sustained trading below key SMAs and trend line suggest further weakness.

- Confluence of 100-day SMA, 50% Fibonacci retracement adds to the upside filter beyond the monthly top.

US dollar index (DXY) remains depressed around 90.40, intraday low of 90.37, ahead of Wednesday’s European session. In doing so, the greenback gauge stretches Friday’s U-turn from a two-month top towards attacking the lowest since January 29.

Also portraying the bearish momentum could be the gauges downside break of a short-term support line, stretched from January 06, marked the previous day, as well as receding strength of the bullish MACD.

Even so, 50-day SMA near 90.40 restricts the dollar moves while joining hands with 23.6% Fibonacci retracement of November-January downside.

Overall, the bears have an upper hand over the USD bulls but are waiting for the fresh impulse to attack the 90.00 threshold, needless to mention about the yearly bottom surrounding 89.20.

Meanwhile, the corrective pullback may attack the previous support line, at 90.76, but further recoveries will have to refresh the multi-day top beyond 91.58 to attack the key hurdle around 91.75, including 50% Fibonacci retracement and 100-day SMA.

DXY daily chart

Trend: Bearish