- DXY bounces off intraday low but snaps three-day winning streak.

- Three-day-old support line tests sellers ahead of 92.25 support confluence.

- Bulls await fresh run-up beyond 93.00 for re-entry.

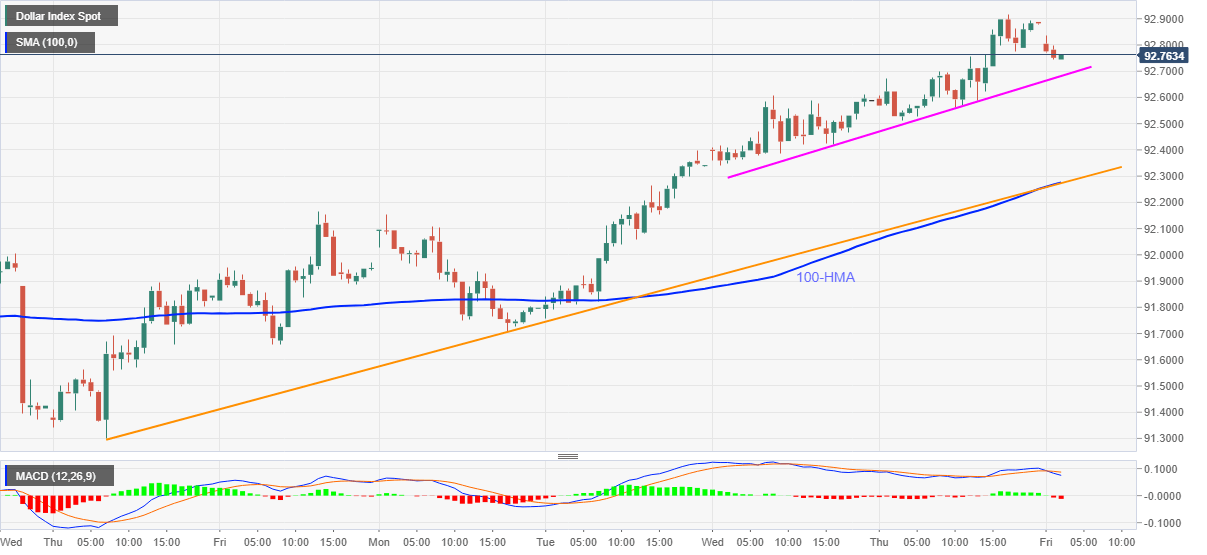

US dollar index (DXY) takes a U-turn from an intraday low of 92.74 to 92.76 but prints 0.13% losses on the day during early Friday. In doing so, the greenback gauge eases from the highest levels last seen on November 13, 2020, poked the previous day, while also declining for the first time in the previous four days.

Although bearish MACD and risk-on mood challenge further upside of DXY, sellers need to break the immediate support line, at 92.68, to tighten the grip.

Even so, a confluence of 100-HMA and an ascending trend line from March 18 will be the tough nut to crack for the bears.

Meanwhile, the 93.00 round-figure guards immediate upside whereas November 11 top near 93.20 could lure the US dollar bulls afterward.

Overall, the US dollar remains in an upward trajectory but buyers are catching a breather and hence a pullback can’t be ruled out.

DXY hourly chart

Trend: Pullback expected