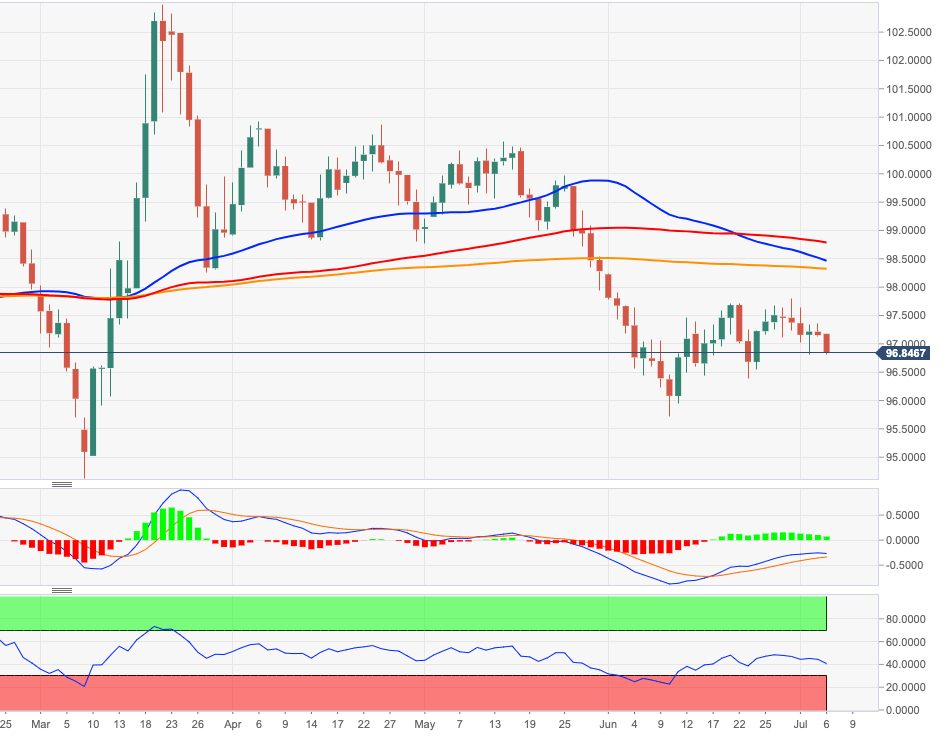

- DXY’s decline picks up pace and breaches the 97.00 support.

- On the downside, the next stop appears in the 96.30 region.

DXY is prolonging the retracement to the sub-97.00 area at the beginning of the week, challenging at the same time new multi-day lows.

If the selling bias picks up pace, the mid-June lows in the 96.30 region should emerge as the next interim support ahead of the Fibo level at 96.03.

While below the 200-day SMA, today at 98.31, the outlook on the dollar is expected to remain negative.

DXY daily chart