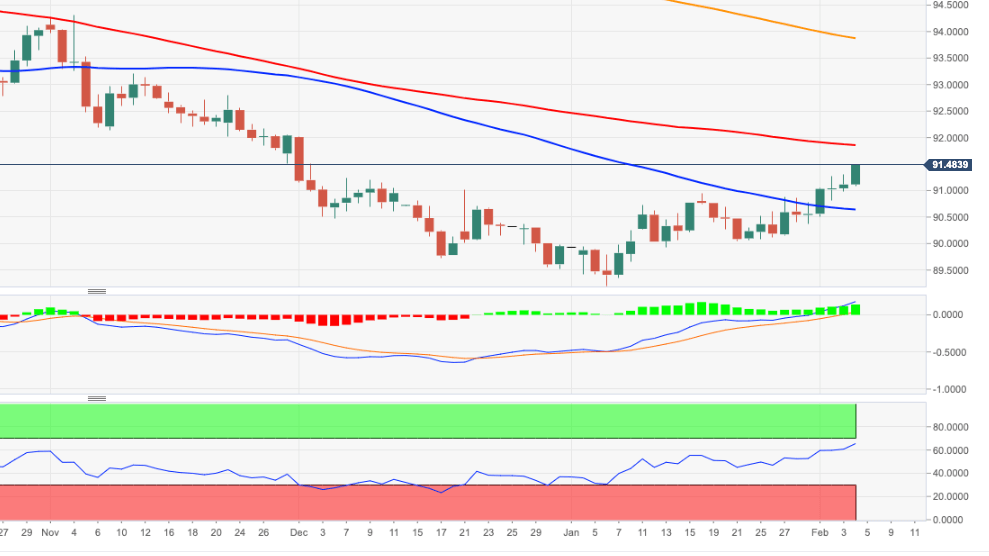

- DXY moves to new 2021 highs near 91.50.

- Further up emerges the 100-day SMA around 91.90.

DXY regains the smile and the upside following Wednesday’s pullback and advances to the 91.50 area, or fresh YTD peaks.

The recent surpass of the 91.00 area gives extra legs to the dollar’s recovery and could motivate the index to attempt a test of, initially, the 100-day SMA in the vicinity of 91.90 in the near-term. The recent breakout of the 2020-2021 resistance line (around 90.80) has mitigated the downside pressure somewhat and reinforces this view.

The ongoing rebound is seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 93.86 the bearish stance is expected to persist.

DXY daily chart