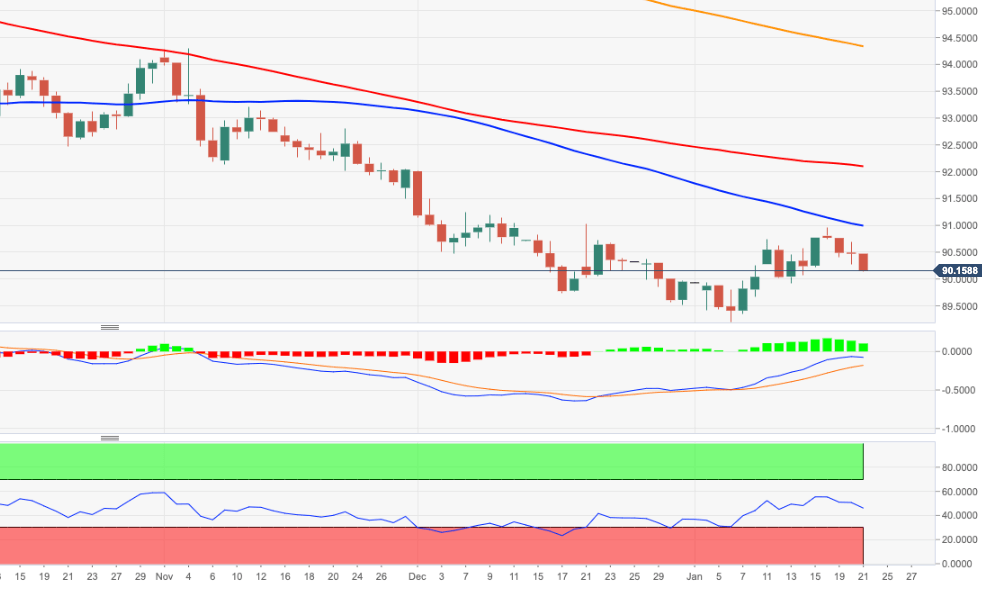

- DXY loses the grip further and approaches the 90.00 level.

- Immediately to the downside comes in the 2021 low at 89.20.

The selling momentum in DXY extends into the Thursday’s session and drags the dollar to the vicinity of the key support at 90.00 the figure.

The inability of USD-bulls to push further north of recent tops in the 91.00 region prompted sellers to return to the market and now the focus of attention shifted to the continuation of the downtrend.

That said, a breach of the 90.00 yardstick should not surprise anyone in the short-term horizon. Below this psychological level is located the 2021 lows around 89.20 ahead of the March 2018 low at 88.94.

The ongoing rebound is seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 94.32, the negative view is expected to persist.

DXY daily chart