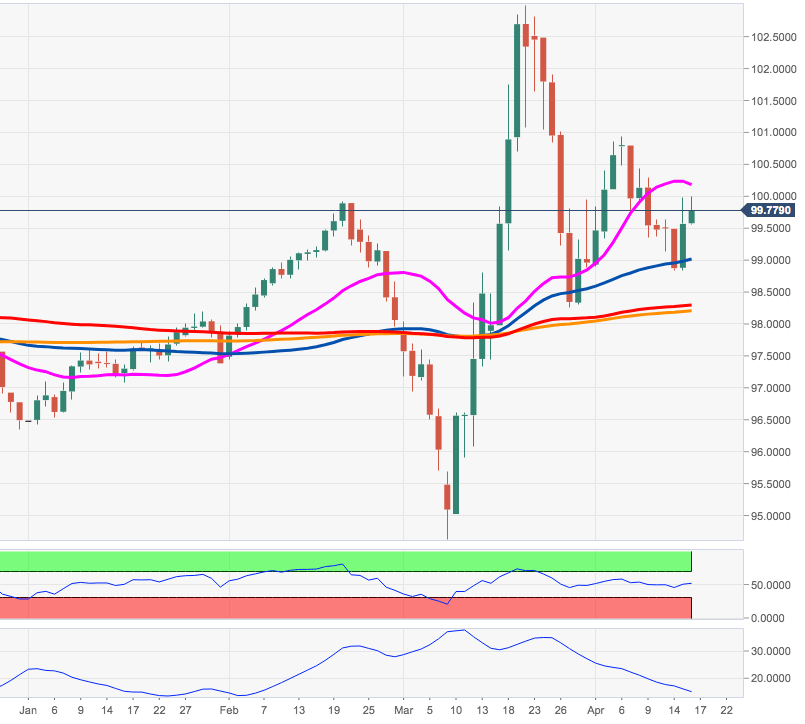

- DXY has extended the corrective upside to the 100.00 area.

- Immediately up emerges the Fibo level near 100.50.

DXY has managed to briefly test the psychological 100.00 mark earlier in the session, coming under selling pressure soon afterwards.

Furthermore, the constructive bias is expected to remain unchanged above the 200-day SMA, today at 98.19. That said, if the index clears the 100.00 mark on a serious note, then the Fibo retracement at 100.59 should return to the radar.

If sellers regain the upper hand, the weekly lows near 98.80 should emerge as the interim contention area.

DXY daily chart