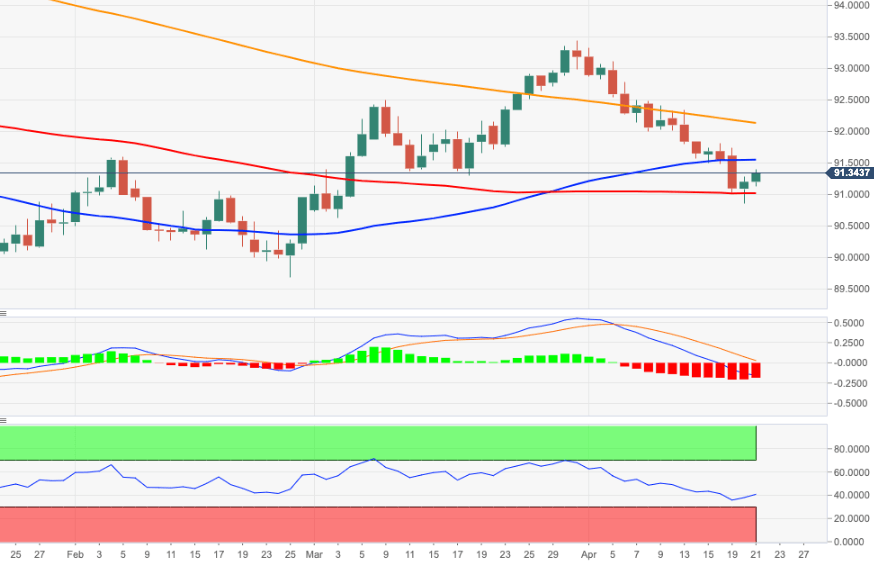

- DXY extends the bounce off lows in sub-91.00 levels.

- There is a minor hurdle at the 50-day SMA (91.63).

DXY adds to the recovery from multi-week lows in the 90.90/85 band, retaking the 91.00 barrier and beyond on Wednesday.

Extra recovery is forecast to meet immediate hurdle at the minor resistance in the 50-day SMA, today at 91.63 ahead of the more relevant 200-day SMA at 92.13.

Above the latter, the index is expected to reclaim a more constructive outlook and allow for extra gains to, initially, the Fibo level (of the 2020-2021 drop) at 92.46.

DXY daily chart