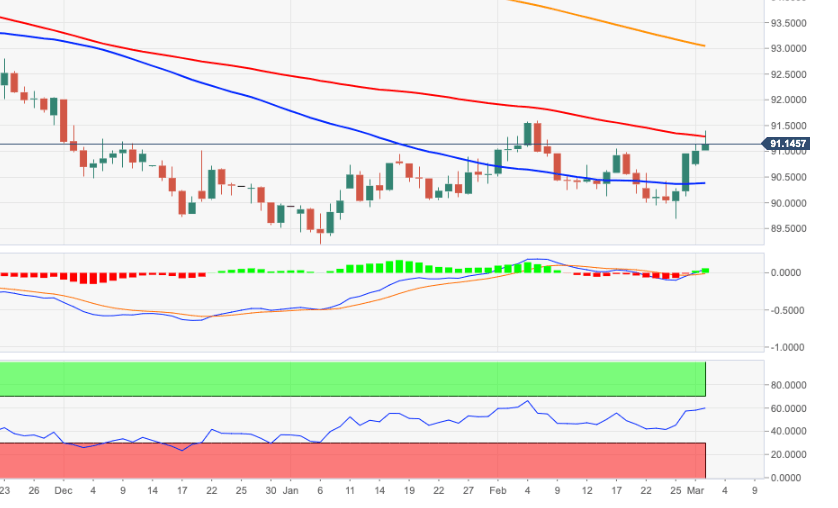

- DXY extends the rebound beyond the 91.00 mark.

- Further north emerge the February peaks around 91.60.

DXY pushes higher and clinches new 4-week peaks near 91.40. This area is coincident with the 100-day SMA (91.29).

The upside momentum in DXY picked up extra pace and carries the potential to extend to the 2021 tops in the 91.60 zone (February 5), where the move is expected to meet a tough barrier.

In spite of the strong rebound, the current spike in DXY is deemed as corrective only, as the broader bearish view still weighs on the dollar. If the 91.60 region is surpassed, then the next focus of attention should shift to the Fibo level (of the 2020-2021 drop) at 92.46.

In the longer run, as long as DXY trades below the 200-day SMA (93.04), the negative stance is expected to persist.

DXY daily chart