- DXY keeps recovering ground lost and approaches 97.00.

- The 200-day SMA in the vicinity of 97.80 caps the upside so far.

After bottoming out in the 96.60 area on Monday, DXY has embarked in a corrective upside to the current vicinity of 97.00. This area of resistance is also reinforced by the resistance line off the 2019 low just above the 95.00 mark.

If buyers manage to extend the current momentum, then the next key level to consider will be the 200-day SMA at 97.79.

In the meantime, as long as the 200-day SMA in the 97.80 zone continues to cap the upside, the bearish stance on the buck should stay unaltered.

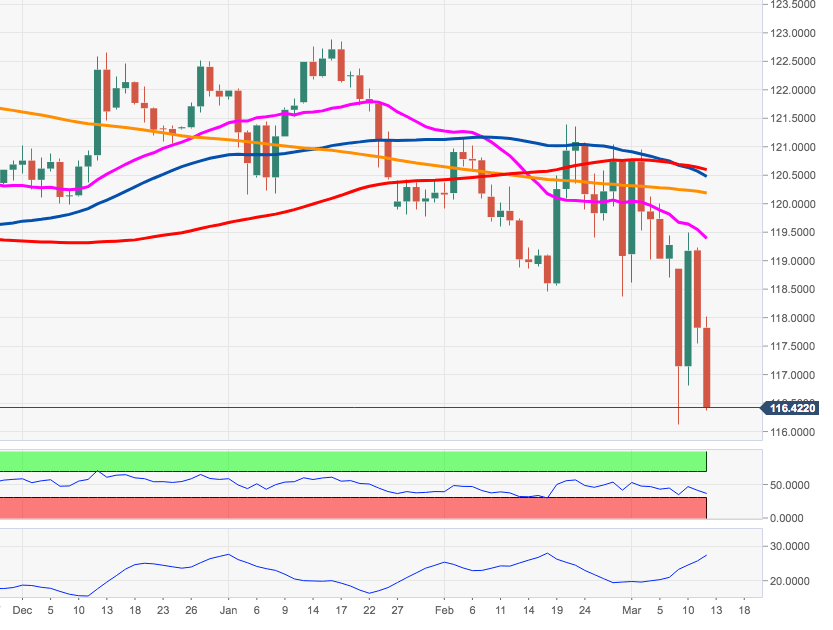

DXY daily chart