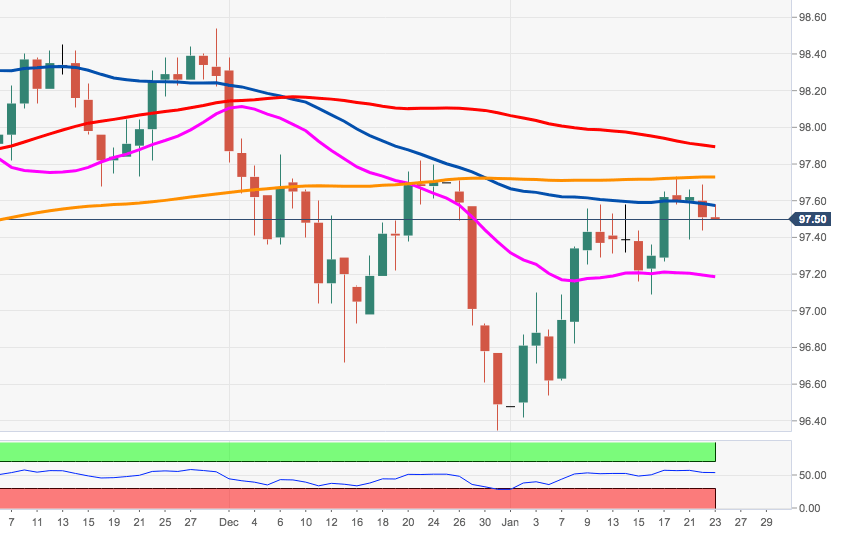

- DXY is so far unable to retake the area of 2020 highs near 97.70.

- Above this level the outlook on the USD should shift to constructive.

The downside corrective in the dollar remains well and sound so far on Thursday and is now flirting with the 55-day SMA at 97.56.

Any serious bullish attempts should target the 97.70 region, where coincide the yearly highs and the critical 200-day SMA. Further up is located a Fibo retracement of the 2017-2018 drop and the 100-day SMA, just below 97.90.

In the short-term, and provided DXY does not resume the upside, some consolidation is thus expected and even a deeper retracement should not be ruled out, all adding to the idea that the index charted an interim top in the 97.70 region.

DXY daily chart