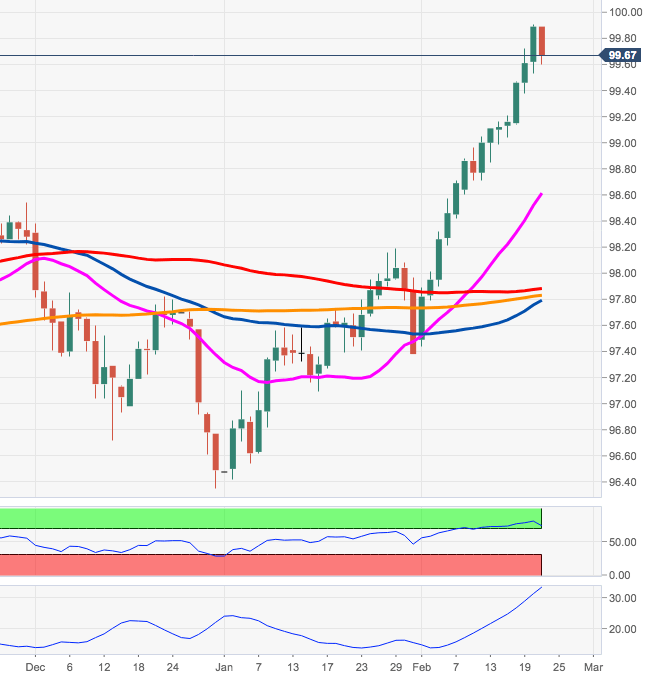

- DXY is facing some profit taking sentiment and recedes from YTD highs.

- While above the 200-day SMA there is still room for a test of 100.00.

The bullish momentum in DXY seems to have run out of steam in the proximity of the key barrier at 100.00 the figure on Thursday.

The current overbought levels in the dollar is also helping with the ongoing knee-jerk, although the underlying positive tone appears unaltered in the short-term horizon.

Looking at the broader picture, while the 200-day SMA at 97.81underpins, the index could still attempt a move to the psychological 100.00 neighbourhood.

DXY daily chart