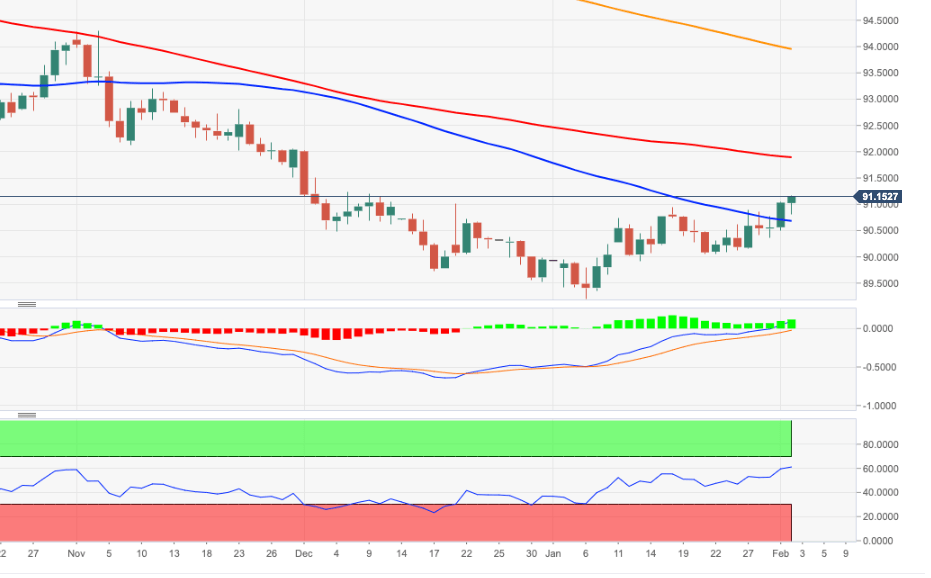

- DXY looks to consolidates the breakout of the 91.00 yardstick.

- Interim hurdle aligns at the 100-day SMA near 91.90.

DXY gathers extra steam and surpasses the 91.00 barrier, clinching at the same time new yearly highs.

A serious breakout of the 91.00 area could lend the dollar extra legs and extends the upside to, initially, the 100-day SMA in the vicinity of 91.90 in the near-term. The recent breakout of the 2020-2021 resistance line (around 90.80) has mitigated the downside pressure somewhat and reinforces the latter.

The ongoing rebound is seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 93.94 the bearish stance is expected to persist.

DXY daily chart