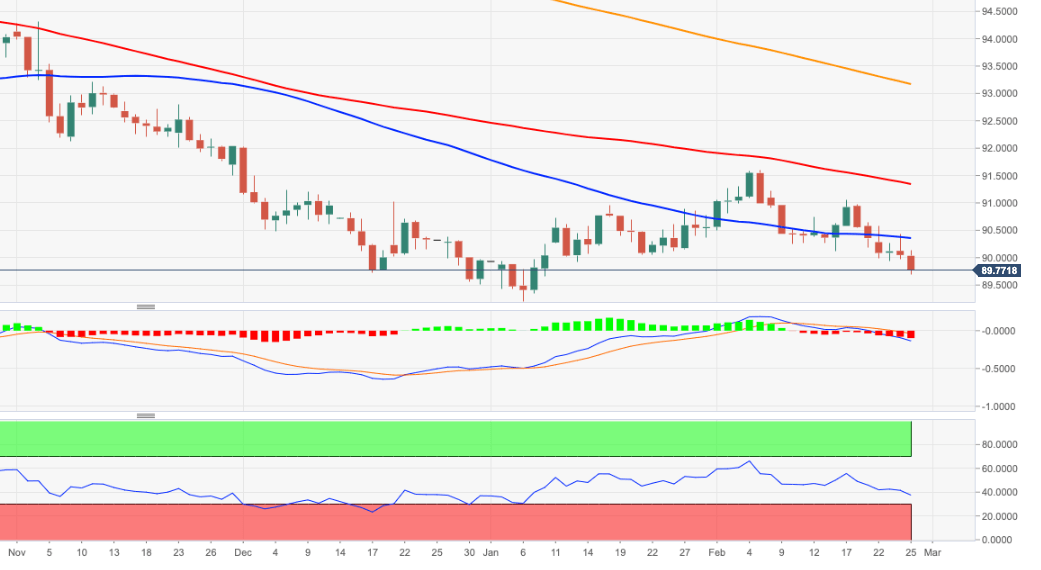

- DXY puts the 2020-2021 support line (89.80) to the test.

- Further south of this area comes in the 2021 lows at 89.20.

DXY resumes the downside and extends the drop further south of the psychological support at the 90.00 yardstick.

Sellers are facing a major contention area around the critical 90.00 level, which is in turn underpinned by the proximity of the 2020-2021 support line. A sustainable breakdown of this zone should open the door to a potential move to the 2021 low at 89.20 (January 6) ahead of the March 2018 low at 88.94.

In the meantime, occasional bouts of upside pressure in the index are deemed as corrective only amidst the broader bearish view on the dollar. That said, bullish attempts to the 91.00 hurdle and beyond could represent selling opportunities against the current backdrop.

In the longer run, as long as DXY trades below the 200-day SMA (93.17), the negative stance is expected to persist.

DXY daily chart