- US Dollar Index steps back from the three-year top.

- Overbought RSI conditions signal further declines towards April 2017 top.

- The yearly high of 2017 will be on the bull’s radar during fresh advances.

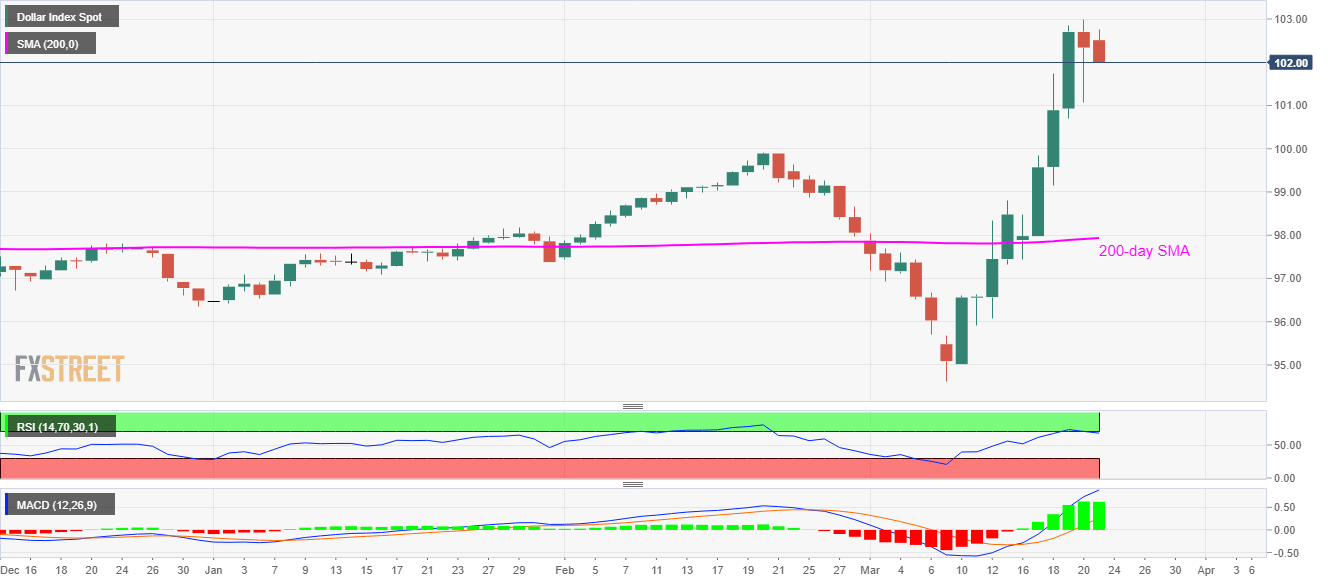

While extending its pullback from 103.00, flashed on Friday, the US dollar Index (DXY) drops to 102.06, down 0.28% while heading into the European open on Monday.

Other than the greenback gauge’s failure to stay strong beyond the 38-month top, overbought RSI conditions also favor the sellers.

As a result, April 2017 top near 99.90 can please the bears during the further downside whereas 200-day SMA around 97.94 could be on their radars afterward.

Alternatively, a sustained break beyond 103.00 will push the bulls towards challenging the year 2017 high close to 103.80.

DXY daily chart

Trend: Pullback expected