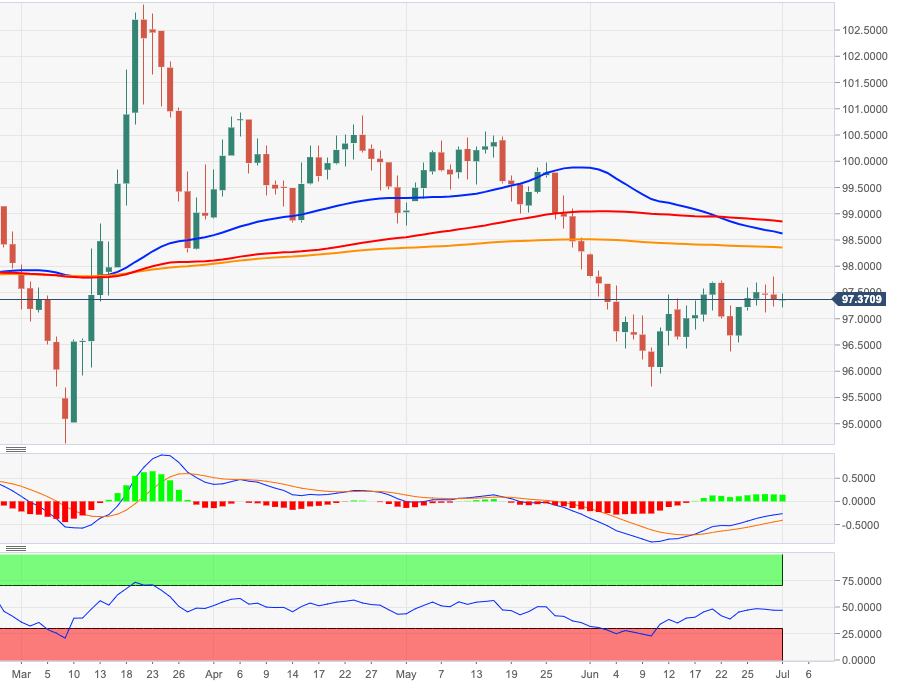

- DXY has failed once again to advance beyond the 97.90 region.

- Further north of this area aligns the key 200-day SMA at 98.34.

DXY remains locked within a consolidative mood with clear topside in the 97.90 region, where converge recent peaks and a Fibo level (of the 2017-2018 drop).

If A surpass of this resistance band should open the door to a potential move beyond 98.00 the figure and a test of the critical 200-day SMA, today at 98.35.

As long as the 200-day SMA, today at 98.35, caps the upside, further losses are still on the table for the dollar.

DXY daily chart