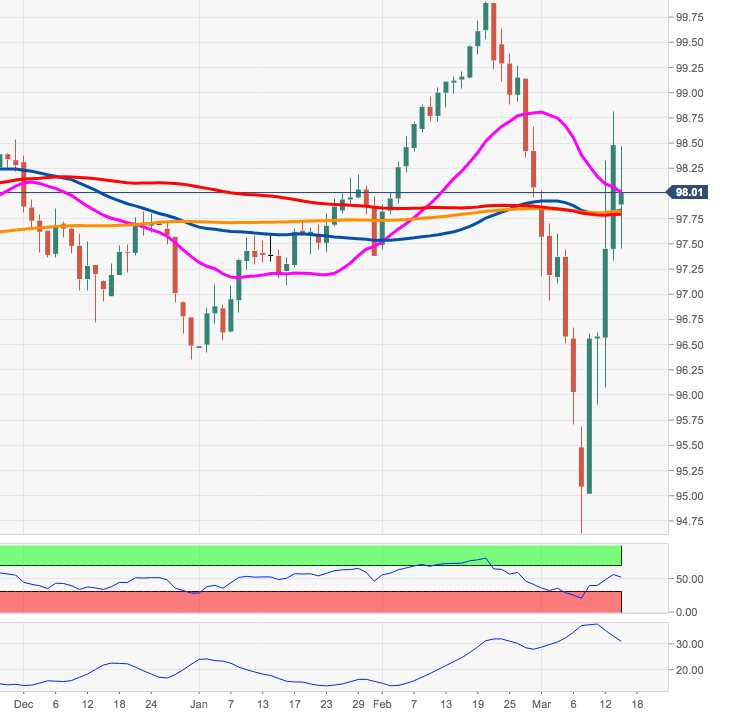

- The upside bias in DXY seems to have met a tough hurdle near 98.80.

- The breach of the 200-day SMA should re-assert the negative stance.

After climbing to 2-week highs in the 98.75/80 band on Friday, DXY is now facing increasing selling pressure and tested the mid-97.00s earlier in the session, where some support appears to have turned up.

If the selling bias intensifies, then the next key level to consider will be the Fibo retracement of the February-March at 97.26 ahead of the (now) support line in the 96.60 region.

Below the 200-day SMA the bearish stance is expected to return to the markets.

DXY daily chart