- DXY drops further and tests the mmid-93.00s.

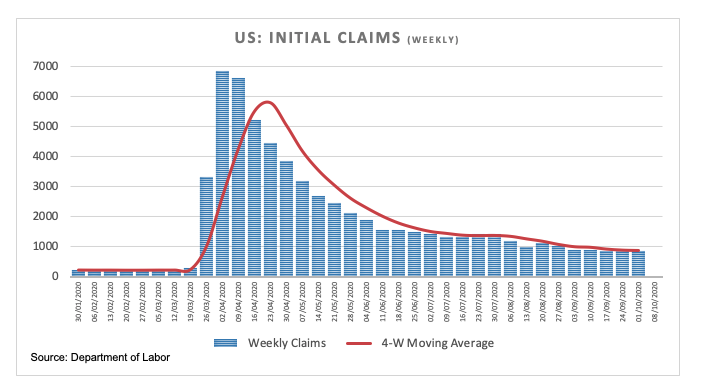

- US Initial Claims rose by 837K WoW, bettering estimates.

- All the attention now is on the September’s ISM Manufacturing.

The greenback, measured by the US Dollar Index (DXY), keeps the daily negative performance unchanged around the 93.50 area on Thursday.

US Dollar Index weaker on risk-on mood

The index is adding to the recent leg lower and drops for the fourth session in a row in the second half of the week, this time to fresh multi-day lows in the 93.50 area.

The better sentiment surrounding the risk complex found extra legs in rising hopes that another extra stimulus package in the US could be discussed/delivered sooner rather than later.

While investors wait for the key ISM Manufacturing for the month of September, weekly Claims rose by 837K, less than forecasted. Additional data saw Personal Income contracting 2.7% MoM in August and Personal Spending expanding 1.0% from a moth earlier. Further out, inflation gauged by the Core PCE rose 0.3% inter-month and 1.6% on a year to August.

What to look for around USD

The index started the week on a soft note and extends the leg lower to the sub-94.00 level towards the end of the trading week. It seems the dollar met an important hurdle at the 94.70 region, where coincide a 6-month resistance line. Occasional bullish attempts in DXY are (still) seen as temporary, however, as the underlying sentiment towards the greenback remains cautious-to-bearish. This view is reinforced by the “lower for longer” stance from the Federal Reserve, hopes of a strong recovery in the global economy, the negative position in the speculative community and political uncertainty ahead of the November elections and over further monetary/fiscal stimulus.

US Dollar Index relevant levels

At the moment, the index is retreating 0.23% at 93.58 and faces the next contention at 93.46 (55-day SMA) followed by 92.70 (weekly low Sep.10) and then 91.92 (23.6% Fibo of the 2017-2018 drop). On the other hand, a break above 94.74 (monthly high Sep.25) would open the door to 95.29 (100-day SMA) and finally 96.03 (50% Fibo of the 2017-2018 drop).