- DXY surpasses the 92.00 mark and clinch 2021 highs.

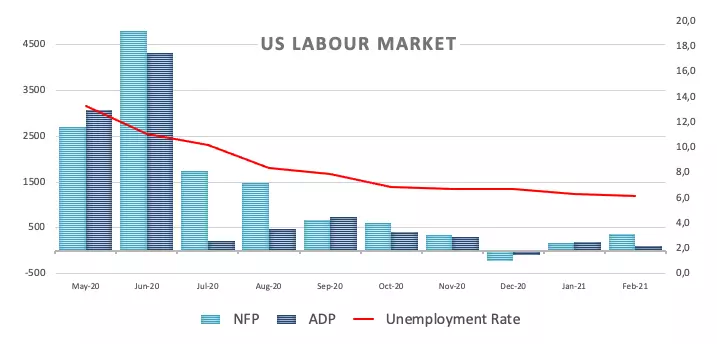

- The US economy added nearly 380K jobs in February.

- The jobless rate eased to 6.2% (from 6.3%).

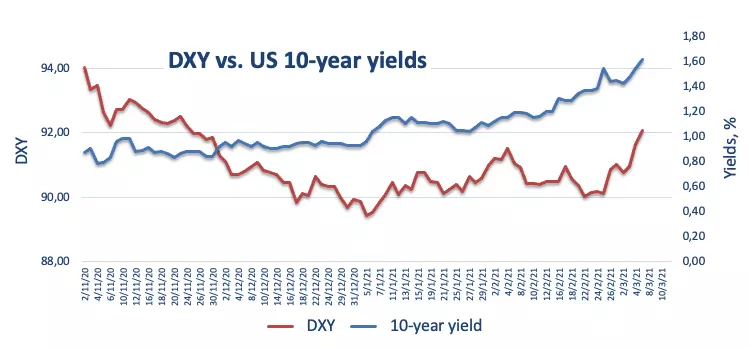

The march north in the greenback remains unabated and trade in fresh 2021 highs beyond the 92.00 hurdle when tracked by the US Dollar Index (DXY).

US Dollar Index firmer on higher yields

The index stays bid around the 92.00 neighbourhood on Friday after the US Nonfarm Payrolls largely surpassed forecasts during February. In fact, the economy added 379K jobs and revised the previous print to 166K jobs.

Further upbeat results saw the Unemployment Rate decreasing a tad to 6.2% (from 6.3%), the Participation Rate unchanged at 61.4% and the Average Hourly Earnings gaining 0.2% from a month earlier.

The push higher in the buck beyond 92.00 was also helped by yields of the US 10-year benchmark briefly testing levels above the 1.60% yardstick for the first time since February 2020.

US Dollar Index relevant levels

At the moment, the index is gaining 0.33% at 91.94 and a breakout of 92.19 (2021 high Mar.5) would open the door to 92.46 (23.6% Fibo of the 2020-2021 drop) and finally 92.93 (200-day SMA). On the other hand, the next support emerges at 90.47 (50-day SMA) seconded by 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6).