- DXY challenges the key 92.00 support on Tuesday.

- US 10-year yields give away gains and recede to the 1.66% area.

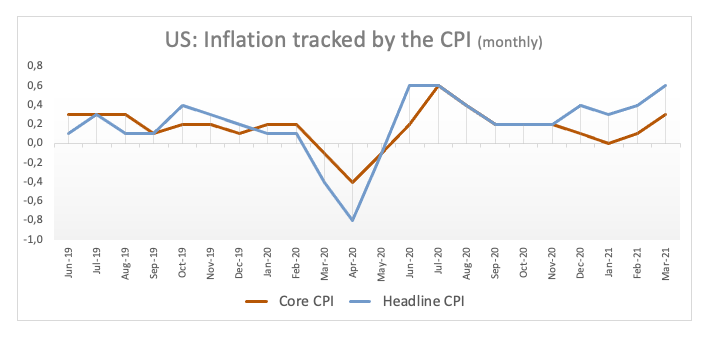

- US CPI rose 0.6% MoM and 2.6% YoY during March.

Increasing selling pressure around the greenback now drags the US Dollar Index (DXY) to fresh weekly lows in the vicinity of the 92.00 neighbourhood.

US Dollar Index offered post-CPI

The index now sheds ground for the second session in a row and flirts with weekly lows near 92.00 the figure after US inflation figures were not enough to re-ignite another bout of strength in both the buck and US yields.

In fact, yields of the key US 10-year reference dropped to the 1.66% region soon after the headline CPI rose 0.6% on a monthly basis and 2.6% over the last twelve months, while the Core CPI gained 0.3% from a month earlier and 1.6% on an annualized view.

Still in the US calendar, the NFIB Business Optimism index bettered to 98.2 in March (from 95.8). Later in the NA session, the API will report on US crude oil stockpiles ahead of speeches by San Francisco Fed M.Daly (voter, centrist), Kansas City Fed E.George (2022 voter, hawkish) and Atlanta Fed R.Bostic (voter, centrist).

What to look for around USD

The dollar keeps navigating the lower bound of the recent range just above the 92.00 neighbourhood after being rejected from YTD highs near 93.50 back in March. DXY now looks under downside pressure, as investors seem to have already priced in the US reflation/vaccine trade. Furthermore, the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery (now postponed to later in the year) remain a source of support for the risk complex and carry the potential to curtail the upside momentum in the dollar in the second half of the year.

Key events in the US this week: Chairman Powell speech, Fed’s Beige Book (Wednesday) – Retail Sales, Initial Claims, Philly Fed Index, Industrial Production (Thursday) – Housing Starts, Building Permits, advanced Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is losing 0.09% at 91.99 and faces the next support at 91.52 (50-day SMA) followed by 91.30 (weekly low Mar.18) and then 91.04 (100-day SMA). On the upside, a break above 93.43 (2021 high Mar.31) would expose 94.00 (round level) and finally 94.30 (monthly high Nov.4).