- The index is prolonging the rebound and keeps targeting 96.00.

- Yields of the key US 10-year note approaches 3.26%.

- US docket includes NFIB index, IBD/TIPP index.

The US Dollar Index (DXY), which measures the buck vs. a basket of its main rivals, is extending the up move and is now approaching the 96.00 area.

US Dollar Index looks to yields, risk-off

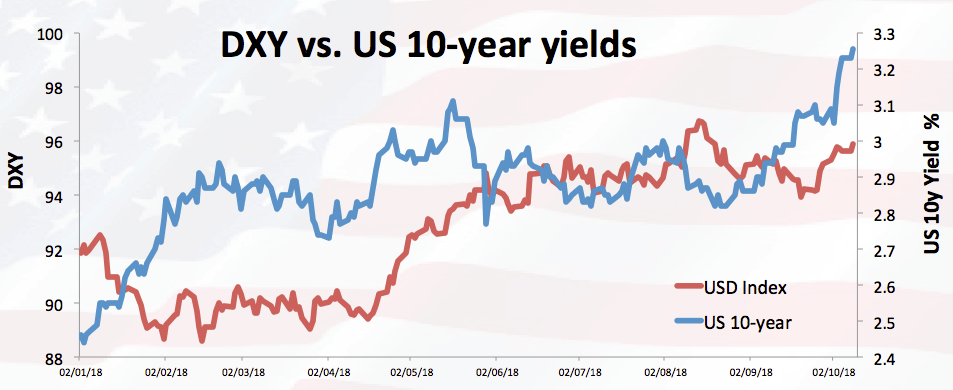

The index is extending the upside momentum in the first half of the week and keeps targeting the critical hurdle at 96.00 the figure, always on the back of persistent concerns in Euroland around Italy and rising yields in the US money markets.

In fact, yields of the key US 10-year reference are closer to the 3.26% level, area last visited in May 2011. The recent rate hike by the Federal Reserve, prospects of further tightening in the next months and hawkish comments from Chief J.Powell have all collaborated with the shift in sentiment around the buck.

Data wise today, second-tier releases should not be a market mover for the greenback, as the NFIB index is due seconded by the Economic Optimism gauge by IBD/TIPP and the speech by Chicago Fed C.Evans.

US Dollar Index relevant levels

As of writing the index is up 0.12% at 95.89 and faces the next hurdle at 96.12 (high Oct.4) seconded by 96.98 (2018 high Aug.13) and finally 97.87 (61.8% Fibo retracement of the 2017-2018 drop). On the other hand, a break below 95.52 (low Oct.5) would aim for 95.38 (10-day SMA) and then 95.15 (55-day SMA).