- DXY remains well on the defensive near 98.00.

- Yields of the US 10-year note up to the 1.53% area.

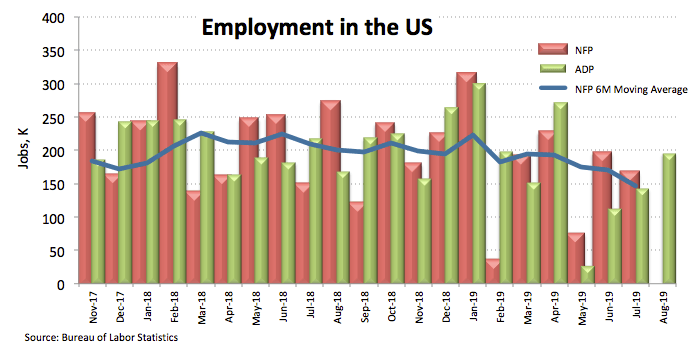

- US ADP report came in at 195K, better than forecasted.

The Greenback stays offered so far on Thursday although it has managed to rebound from earlier lows in the vicinity of the 98.00 handle when tracked by the US Dollar Index (DXY).

US Dollar Index gains traction on data

The index has retreated to fresh multi-day lows near 98.00 the figure earlier on Thursday against the current backdrop of renewed selling pressure hitting the buck.

Concerns over a potential recession in the US economy – likely to develop at some point in 2020/2021 – and alleviated jitters on the US-China trade war after officials said talks are expected to resume next month have been weighing on the index as of late, while the downside pressure has particularly exacerbated in response to Tuesday’s poor print from the ISM Manufacturing.

However, some decent contention appears to have emerged near the 98.00 floor and after the ADP report surprised to the upside in August at 195K. additional positive data saw Nonfarm Productivity expanding 2.3% QoQ in Q2 and Unit Labor Costs up 2.6% QoQ during the same period. Initial Claims, on the other hand, came in a tad above estimates at 217K WoW, taking the 4-Week Average to 216.25K from 214.75K.

Later in the session, the key ISM Non-manufacturing is due seconded by Factory Orders, Durable Goods Orders and the weekly report on US crude oil inventories by the EIA.

What to look for around USD

DXY continues to digest Wednesday’s sharp pullback amidst the improvement in US yields in response to positive headlines from the US-China trade front, all immersed into the generalized better mood in the risk-associated complex. However, the constructive view in the Greenback looks firm in spite of renewed speculations on a probable recession in the US economy at some point in the next couple of years. Supporting this view emerge a solid labour market, strong consumer confidence and positive GDP readings as of late, while inflation is seeing regaining upside traction in the near term. On the other side, Chief Powell’s ‘mid-term adjustment’ could extend further in the next months in order to ‘sustain the expansion’, opening the door to potential extra rate cuts.

US Dollar Index relevant levels

At the moment, the pair is retreating 0.16% at 98.24 and a breach of 98.14 (low Sep.5) would aim for 97.54 (55-day SMA) and finally to 97.17 (low Aug.23). On the other hand, the initial resistance lines up at 99.37 (2019 high Sep.3) seconded by 99.89 (monthly high May 11 2017) and then 100.00 (psychological level).