- DXY bounces off Monday’s lows near 96.50, approaches 97.00.

- The correction in the risk complex gives legs to the dollar on Tuesday.

- Fedspeak, IBD/TIPPIndex next of note on the US calendar.

The greenback, when tracked by the US Dollar Index (DXY), has managed to regain some poise near 96.50 and is now looking to regain the 97.00 mark (and potentially above).

US Dollar Index looks to risk trends

The index is posting modest gains on turnaround Tuesday following two consecutive pullbacks and a drop to the vicinity of the 96.50 level at the beginning of the week.

The ongoing bias towards the riskier assets has been weighing on the dollar so far this month, motivating DXY to abandon the area of recent tops near 97.90 and to re-focus instead on the downside.

In fact, solid and rising hopes of a strong recovery in the global economy have lent support to the risk-associated complex in past sessions, relegating at the same time concerns over the unabated advance of the coronavirus pandemic.

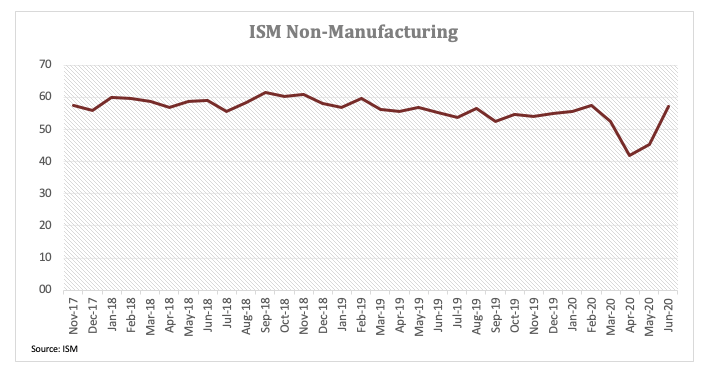

Adding to the upbeat mood in the risk universe, key fundamentals in both the US and Europe have also collaborated with the ongoing sentiment. That said, Monday’s ISM Non-Manufacturing came in well above estimates at 57.1 for the month of June, adding to the recent improvements in the labour market and the manufacturing sector.

In the US data space, JOLTs Job Openings is due seconded by the IBD/TIPP Index and the weekly report on US crude oil supplies by the API. In addition, Atlanta Fed R.Bostic (2021 voter, centrist) is due to speak along with FOMC’s R.Quarles (permanent voter, centrist), Richmond Fed T.Barkin (2021 voter, centrist) and San Fracisco Fed M.Daly (2021 voter, centrist).

What to look for around USD

The progress of the COVID-19 in the US remains in the centre of the debate amidst efforts to keep the re-opening of the economy well in place. As always, the broad risk appetite trends emerge as the main driver for the dollar in the short-term coupled with omnipresent US-China trade and geopolitical effervescence. On the constructive stance around the buck, bouts of risk aversion should support the investors’ preference for the greenback as a safe haven along with its status of global reserve currency and store of value. Playing against this, the ongoing (and potentially extra) stimulus packages by the Federal Reserve could limit the dollar’s upside.

US Dollar Index relevant levels

At the moment, the index is gaining 0.17% at 96.94 and faces the next contention at 96.57 (weekly low Jul.6) seconded by 96.39 (weekly low Jun.23) and finally 96.03 (50% Fibo of the 2017-2018 drop). On the other hand, a break above 97.80 (weekly high Jun.30) would aim for 97.87 (61.8% Fibo of the 2017-2018 drop) and finally 98.30 (200-day SMA).