- DXY moves higher and reclaims the 92.00 mark and above.

- US 10-year yields drop further to the 1.65% area on Tuesday.

- Powell’s testimony will be the salient event later in the NA session.

The greenback, when gauged by the US Dollar Index (DXY), quickly leaves behind Monday’s inconclusive session and manages to regain the 92.00 yardstick and above.

US Dollar Index focused on yields, data

Having started the week with marginal losses, the index regains the upper hand and returns to the area above 92.00 the figure on turnaround Tuesday.

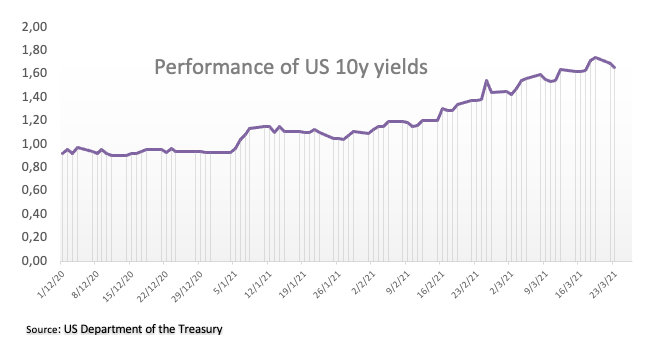

The move higher in the dollar comes despite yields of the key US 10-year reference tumble to fresh lows in the vicinity of the 1.64% level, extending the correction lower from Friday’s 14-month peaks just below 1.75%.

Later in the NA session, all the looks will be upon the testimony by Chairman Powell on “Coronavirus Aid, Relief, and Economic Security Act” before Committee on Financial Services.

In addition, St.Louis Fed J.Bullard (2022 voter, dovish), Atlanta Fed R.Bostic (voter, centrist), Richmond Fed T.Barkin (voter, centrist) and FOMC’s Governor L.Brainard (permanent voter, dovish) are all due to speak later on Tuesday.

In the US data space, Q4 Current Account, the March’s Richmond Fed Manufacturing Index and February’s New Home Sales are to be published.

What to look for around USD

The greenback manages well to keep business in the upper end of the recent trading range and eyes a potential visit to the yearly highs around 92.50 in the not-so-distant future. The recently approved fiscal stimulus package adds to the ongoing outperformance of the US economy narrative as well as the investors’ perception of higher inflation in the next months, all morphing into extra oxygen for the buck. However, the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery remain an omnipresent source of support for the risk complex and are seeing limiting the dollar’s upside for the time being.

Key events in the US this week: Chairman Powell testimonies before the House of Representatives and the Senate on Tuesday and Wednesday, respectively – Flash Markit’s PMIs, Durable Goods Orders (Wednesday) – Final Q4 GDP, Initial Claims (Thursday) – February’s PCE, Personal Income/Spending, final U-Mich Index (Friday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.36% at 92.07 and a breakout of 92.50 (2021 high Mar.9) would expose 92.63 (200-day SMA) and finally 94.30 (monthly high Nov.4). On the other hand, the next support is located at 91.30 (weekly low Mar.18) seconded by 91.05 (high Feb.17) and then 90.93 (50-day SMA).