- DXY stays close to YTD highs in the 98.60/65.

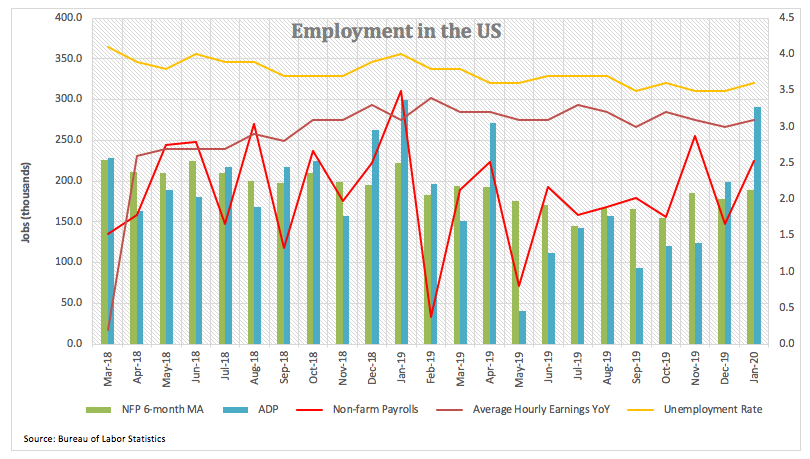

- The US economy added 225K jobs in January.

- The unemployment rate rose a tad to 3.6%.

The US Dollar Index (DXY), which tracks the greenback vs. a basket of its main rivals, keeps the bid tone intact although it has practically ignored the results from January’s Payrolls.

US Dollar Index stay close to 2020 highs

The index is posting gains since Monday, sharply reversing the previous week’s pullback to the 97.30 region and managing to return to levels last seen in mid-October 2019 beyond 98.60.

The better tone in the risk complex, positive results from the US docket and auspicious headlines from the US-China trade front and diminishing concerns around the Wuhan coronavirus have all been collaborating with this kind of shift in the sentiment towards the buck amidst, of course, the increasing weakness in the likes of the euro, the yen and the quid.

The dollar, in the meantime, is closing its best weekly performance since early November 2019 after Non-farm Payrolls surpassed expectations in January. In fact, the economy created 225K jobs (vs.165K forecasted), the jobless rate rose to 3.6% (from multi-decade lows at 3.5%) and Average Hourly Earnings – a proxy of wage inflation – expanded 3.1% from a year earlier.

What to look for around USD

The index extended the rally to the area above 98.60 to clinch new 2020 peaks. Following the neutral/dovish message from the FOMC, investors should keep looking to the performance of US fundamentals and the broader risk appetite trends for direction. So far, the constructive view on the dollar remains propped up by the current ‘wait-and-see’ stance from the Fed vs. the broad-based dovish view from its G10 peers, tge ‘good shape’ of the domestic economy and the dollar’s status of ‘global reserve currency’.

US Dollar Index relevant levels

At the moment, the index is gaining 0.11% at 98.58 and a break above 98.65 (2020 high Feb.7) would aim for 98.93 (high Aug.1 2019) and finally 99.37 (high Sep.3 2019). On the other hand, the next support is seen at 97.87 (68.2% Fibo of the 2017-2018 drop) followed by 97.72 (200-day SMA) and then 97.35 (weekly low Jan.31).