- DXY now posts modest gains although still below 93.00.

- The dollar is now bid and reverses two pullbacks in a row.

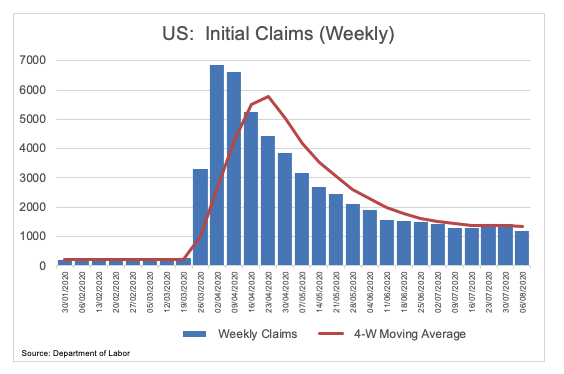

- Initial Claims rose by nearly 1.2 million during last week.

The US Dollar Index (DXY), which tracks the greenback vs. a basket of its main rivals, has regained some composure and is now looking to re-test the 93.00 barrier.

US Dollar Index struggles to surpass 93.00

The index is now picking up extra upside traction and leaves behind two consecutive sessions in the red, including fresh lows in levels last seen in May 2018 just pips above 92.50.

Investors’, in the meantime, keep looking to the US political arena, where further discussions on a new stimulus package are expected to resume later on Thursday.

In the US calendar, weekly Initial Claims rose by 1.186 million, bettering estimates and coming down from the previous 1.435 million print. Earlier data saw Challenger Job Cuts rising 576.1% to 262,249K during July.

What to look for around USD

The dollar’s recovery appears to have run out of favour in the 94.00 region on Monday, resuming the downside soon afterwards and re-shifting its focus to recent lows in the mid-92.00s (July 31). Looking at the broader picture, investors keep the bearish stance on the currency unchanged against the usual backdrop of a dovish Fed, the unabated advance of the pandemic, US-China effervescence and somewhat diminishing momentum in the economic recovery. Also weighing on the buck, market participants seem to have shifted their preference for other safe havens instead of the greenback on occasional bouts of risk aversion. On another front, the speculative community remained well into the negative territory for yet another week, adding to the idea of a more serious bearish trend in the dollar.

US Dollar Index relevant levels

At the moment, the index is up 0.10% at 92.90 and a break above 93.99 (weekly high Aug.3) would target 94.20 (38.2% Fibo of the 2017-2018 drop) en route to 96.03 (50% Fibo of the 2017-2018 drop). On the downside, the next support is located at 92.55 (2020 low Jul.31) seconded by 91.80 (monthly low May 18) and finally 89.23 (monthly low April 2018).