- DXY keeps the bid bias unchanged above 90.00.

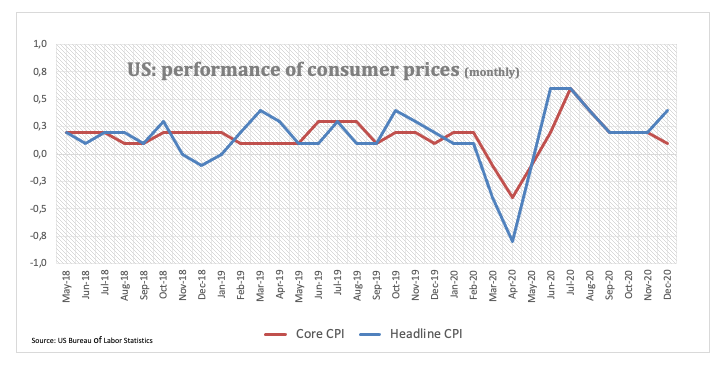

- US December headline CPI rose 0.4% MoM, Core CPI 0.1% MoM.

- Fed’s Beige Book, Fedspeak next of note in the docket.

The US Dollar Index (DXY), which tracks the buck vs. a basket of its main competitors, keeps the buying interest unaltered above 90.00 so far on Wednesday.

US Dollar Index now looks to Fedspeak

The index keeps the upbeat momentum and manages to regain the 90.00 barrier and above so far on Wednesday, leaving behind a bout of selling pressure earlier in the session.

In the meantime, yields of the US 10-year reference eases a tad from recent tops and navigate the 1.12% area following the recent inflation figures.

In fact, headline consumer prices rose at a monthly 0.4% in December, while prices stripping food and energy costs rose at a meagre 0.1% from a month earlier. Later, the EIA will release its weekly report on crude oil inventories ahead of the Fed’s Beige Book.

In addition, St. Louis Fed J.Bullard (2022 voter, dovish), FOMC’s L.Brainard (permanent voter, dovish), Philly Fed P.Harker (2023 voter, hawkish) and FOMC’s R.Clarida (permanent voter, dovish) are all due to speak throughout the session.

What to look for around USD

The index regained buying interest after bottoming out in the 89.20 area in the first trading week of the new year and managed to advance to the proximity of 90.70 so far this week, where some relevant resistance turned up. The recovery in US yields keeps lending support to the greenback as investors continue to perceive a potential pick-up in inflation pressure/expectations in response to the most likely increment in fiscal stimulus under a Democrat White House. However, the outlook for the greenback remains fragile in the short/medium-term for the time being amidst massive monetary/fiscal stimulus in the US economy, the “lower for longer” stance from the Federal Reserve and prospects of a strong recovery in the global economy.

US Dollar Index relevant levels

At the moment, the index is gaining 0.21% at 90.28 and a breakout of 90.72 (2021 high Jan.11) would open the door to 91.01 (weekly high Dec.21) and finally 91.23 (weekly high Dec.7). On the other hand, immediate contention is located at 89.20 (2021 low Jan.6) followed by 88.94 (monthly low March 2018) and the 88.25 (monthly low February 2018).