- DXY keeps the trade above 93.00 albeit below daily highs.

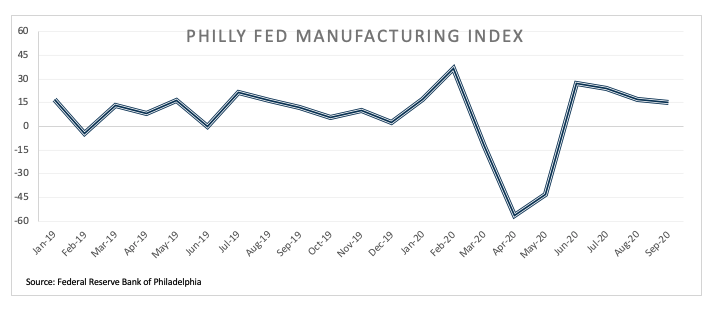

- US Philly Fed index came in at 15.0 in September, matching consensus.

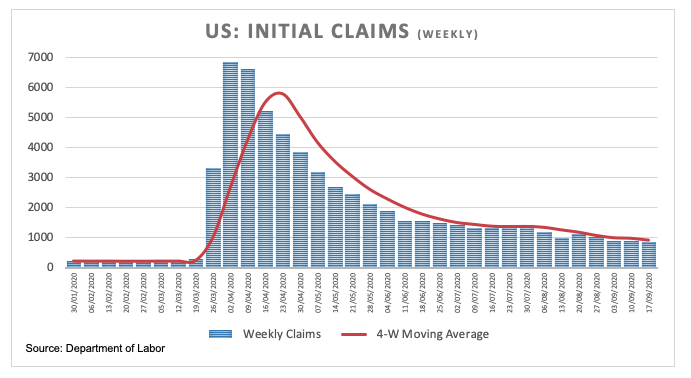

- Initial Claims came in short of estimates at 860K during last week.

The greenback keeps the positive mood unaltered so far on Thursday and takes the US Dollar Index (DXY) to the 93.20 region following US data releases.

US Dollar Index stays bid after FOMC

The index has trimmed earlier losses after USD-bulls failed to extend the rebound further north of the 93.55/60 band during early trade.

In fact, the dollar continues to fade the post-FOMC gains and is now gradually approaching the key 93.00 neighbourhood, as investors appear to have already digested the latest message from the Fed.

In the US data space, weekly Initial Claims increased by 860K, coming in a tad short of expectations. Further results in the US calendar saw the key regional manufacturing gauge tracked by the Philly Fed index at 15.0 for the current month, in line with forecasts.

Data from the US housing sector showed both Housing Starts and Building Permits decreased to 1.416 million units (or 5.1%) and 1.470 million units (or 0.9%), respectively, during last month.

What to look for around USD

The dollar regained the smile following the FOMC event on Wednesday and reached the 93.60 level earlier on Thursday, where some relevant barrier appears to have emerged. The current recovery in DXY, however, is still considered as corrective only amidst the broad bearish stance surrounding the dollar, the “lower for longer” stance from the Federal Reserve, the unremitting advance of the coronavirus pandemic and political uncertainty ahead of the November elections.

US Dollar Index relevant levels

At the moment, the index is gaining 0.14% at 93.23 and a break above 93.66 (monthly high Sep.9) would open the door to 93.99 (monthly high Aug.3) and finally 94.20 (38.2% Fibo of the 2017-2018 drop). On the other hand, the next support emerges at 92.70 (weekly low Sep.10) seconded by 91.92 (23.6% Fibo of the 2017-2018 drop) and then 91.75 (2020 low Sep.1).