- The index looks to add to Thursday’s gains near 96.30.

- Yields of the US 10-year note climb beyond 2.71%.

- Core PCE, ISM manufacturing next of relevance in the calendar.

Tracked by the US Dollar Index (DXY), the greenback is adding to recent gains and is approaching the 96.30 region ahead of the opening bell in the Old Continent.

US Dollar Index looks to risk trends, data

The index is slowly advancing for the third session in a row at the end of the week, retaking the 96.00 milestone and above after bottoming out in new 3-week lows in the 95.80 region.

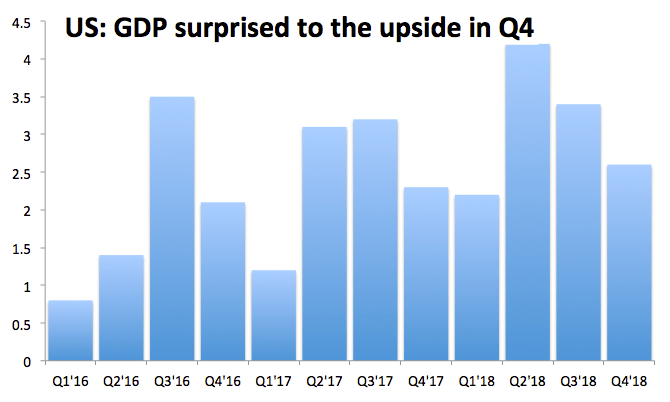

Fading optimism over the proximity of a deal in the US-China trade dispute has sparked a reaction in the greenback, which has been also supported by yesterday’s publication of better-than-expected advanced US Q4 GDP figures.

Moving forward, the ISM will release its key manufacturing gauge later today seconded by the final print of the U-Mich index and inflation figures measured by the PCE.

What to look for around USD

The US-China trade negotiations remain in centre stage and are expected to keep ruling the sentiment in the weeks to come. However, the health of the US economy has come back to the fore following auspicious results from the Q4 GDP, which appear to have not only motivated USD bulls to return to the markets but also poured cold water over speculations of a potential halt of the Fed’s tightening cycle.

US Dollar Index relevant levels

At the moment, the pair is gaining 0.02% at 96.25 and a break above 96.39 (21-day SMA) would open the door to 96.79 (23.6% Fibo of the September-December up move) and finally 97.37 (2019 high Feb.15). On the flip side, initial contention emerges at 95.82 (low Feb.28) seconded by 95.65 (200-day SMA) and then 95.16 (low Jan.31).