- DXY looks to extend Friday’s gains to the 91.00 area.

- US 10-year yields navigate above the 1.40% level so far.

- US ISM Manufacturing, Fedspeak next on the docket.

The greenback meets strong resistance in the vicinity of the 91.00 neighbourhood when tracked by the US Dollar Index (DXY) at the beginning of the week.

US Dollar Index looks to yields, data

Following Friday’s strong advance, the index finds some resistance to extend the move higher and potentially re-test the key barrier at 91.00 the figure on Monday.

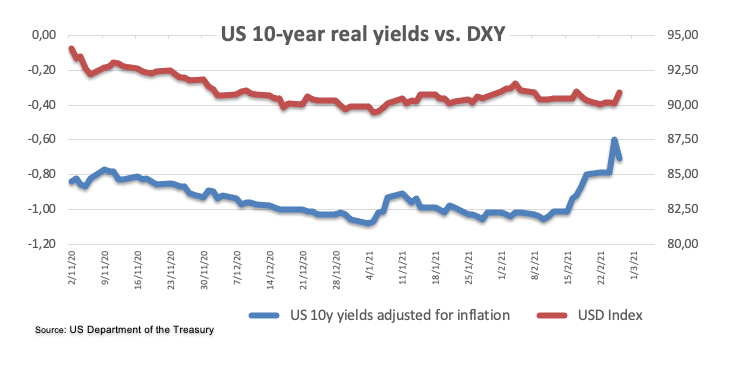

The recent recovery in the dollar came in tandem with the sharp bounce in yields in the US bond market, where the 10-year reference managed to briefly visit the area above 1.55% for the first time since February 2020 (February 25).

While prospects of higher inflation in the months to come (and their echo on real yields) and the outperformance of the US economy vs. its G10 peers continue to underpin bouts of strength in the buck, the increasing likeliness of further fiscal stimulus and the strong recovery predicted in the global economy post-pandemic stay as the main support for inflows into the risk-associated universe.

Later in the session, the ISM Manufacturing will take centre stage seconded by Markit’s final PMIs for the month of February and the speech by FOMC’s permanent voter L.Brainard (dovish).

What to look for around USD

The index manages to regain the upper hand and approach the 91.00 yardstick. The reversion of the recent weakness in the dollar came in tandem with the strong bounce of yields to levels last recorded a year ago. While the reflation/vaccine trade continues to keep bullish attempts in the buck contained, bouts of concerns regarding a pick-up in inflation (and inflation expectations) stemming from the expected extra fiscal stimulus could provide some pockets of strength in the dollar for the time being. Against this, occasional upside in the buck should remain short-lived amidst the broad-based bearish outlook for the currency in the medium/longer-term. This, in turn, is propped up by the reinforced mega-accommodative stance from the Fed until “substantial further progress” is seen, persistent chatter of extra fiscal stimulus and prospects of a strong recovery in the global economy, which are all seen underpinning the better sentiment in the risk complex.

Key events in the US this week: ISM Manufacturing PMI (Monday) – ADP Report, ISM Non-Manufacturing, Fed’s Beige Book (Wednesday) – Initial Claims, Powell’s speech (Thursday) – Nonfarm Payrolls (Friday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.01% at 90.89 and a breakout of 90.97 (weekly Feb.26) would open the door to 91.05 (weekly high Feb.17) and finally 91.60 (2021 high Feb.5). On the other hand, the next support emerges at 89.68 (weekly low Feb.25) seconded by 89.20 (2021 low Jan.6) and then 88.94 (monthly low March 2018).